Table of Contents

ToggleBusiness Tradelines for Sale

BUILD BUSINESS CREDIT WITH US!

MONEY BACK GUARANTEE!

You can call/text the Tradeline Department 9-5 PT 7 days a week direct at:

(725) 290-2778

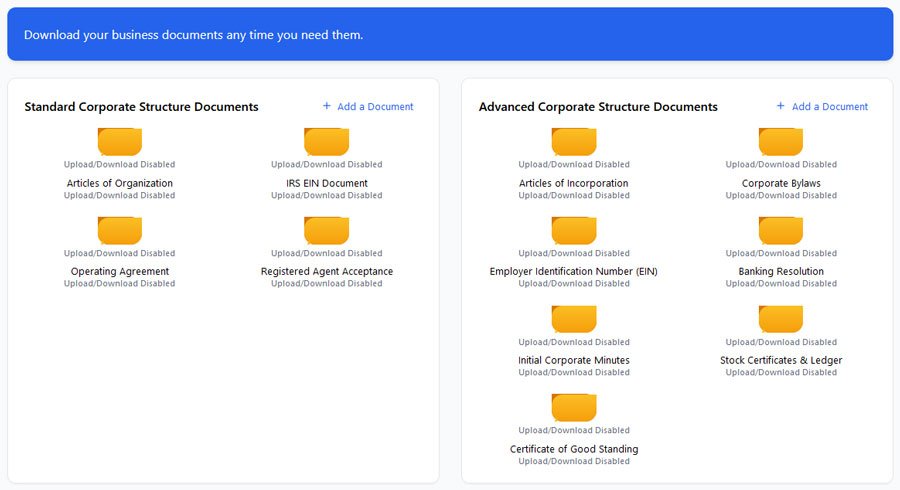

REQUIRED DATA NEEDED FOR SUCCESSFUL BUSINESS TRADE LINE POSTING TO YOUR BUSINESS CREDIT PROFILE

Please provide the following details:

- Business Name

- Business Address

- Business Email

- Business Phone

- Corporate ID Number (Found on Articles of Incorporation)

- Business EIN

- Date Business Filed

Submission Instructions

Copy and paste the text above with the business details requested above and put it in an email to us at: support@legalnewcreditfile.com

Note for Existing Clients: If you established your business through our services, we still request that you complete this information in full. While we will verify these details against your existing business file, providing this information ensures you have access to and knowledge of your essential business documentation for future management purposes.

We appreciate your cooperation and look forward to assisting you with your business trade lines.

This may sound unbelievable, but our tradelines actually post. Imagine that – a company that actually delivers on its promises. Pretty cool, right? 😄

-

Small Business Loans:

The Small Business Administration (SBA) guarantees loans, making it easier for startups to secure funding. In 2023, the SBA backed loans totaling over $28 billion.

-

Growing Entrepreneurial Support

Over 7,000 business incubators and 200 accelerators worldwide offer mentorship, workspace, and funding to startups.

-

Government Grants:

There are numerous federal and state grants available, such as the Small Business Innovation Research (SBIR) program, which offers up to $1 million in funding for startups engaged in technological innovation.

-

Flexible Working and Lifestyle

Autonomy: Entrepreneurs enjoy the flexibility of setting their own hours, choosing projects, and building a company culture that aligns with their values.

-

Small Business Impact:

Small businesses make up 99.9% of all U.S. businesses, highlighting the vast market and the potential for growth.

Business Tradelines for Sale – Boost Business Credit – 80+ PAYDEX SCORE!

- Key Takeaways

- Understanding Business Tradelines

- Benefits of Adding Tradelines

- How Tradelines Boost Credit

- Choosing the Right Tradelines

- Free Tradelines You Can Use

- Avoiding Bad Tradeline Choices

- Common Misconceptions About Tradelines

- Steps to Purchase Tradelines

- Building Credit Without Tradelines

- Final Remarks

- Frequently Asked Questions

Business tradelines for sale can be a game-changer for your financial journey. These tradelines help boost your credit score, making it easier to secure loans and favorable interest rates. Historically, savvy entrepreneurs have used tradelines to enhance their business credibility and access better funding options.

You can tap into this powerful tool to elevate your business potential. Investing in quality tradelines allows you to leverage the credit history of established accounts. This strategy not only improves your creditworthiness but also opens doors to new opportunities. Understanding how to navigate the world of tradelines is essential for anyone serious about growing their business.

Key Takeaways

- Understand Tradelines: Familiarize yourself with what Business Tradelines for Sale are and how they work to effectively improve your credit profile.

- Leverage Benefits: Consider the advantages of adding tradelines, such as increased credit limits and improved credit scores, to enhance your business’s financial standing.

- Choose Wisely: When selecting tradelines, prioritize those that align with your business needs and financial goals to maximize their impact.

- Explore Free Options: Look into free tradelines available to you; they can provide a cost-effective way to boost your credit without financial strain. Our Secret to Wealth Series Volume 2 that comes with your business build out package covers everything step by step to get your PAYDEX score posted quick.

- Think Beyond Tradelines: Remember that building credit can also be achieved through other methods like timely payments and responsible borrowing, which are crucial for long-term success.

Understanding Business Tradelines for Sale

Definition

You can think of business tradelines as accounts that report your business’s credit activity. These accounts show how well your business manages its debts. They play a key role in building your business credit profile by establishing trade lines. Each tradeline includes details like the date opened, credit limit, and payment history.

Tradelines are essential for obtaining business funding. Lenders check these accounts to assess your creditworthiness. A strong business credit profile can lead to better loan terms and lower interest rates.

Personal vs. Business Tradelines for Sale

You should understand the difference between personal and business tradelines. Personal tradelines reflect an individual’s credit history. These include personal loans, credit cards, and mortgages. In contrast, business tradelines focus solely on your company’s financial activities.

Your Experian or NAV business credit profile will contain only business tradelines. This profile is separate from your personal credit report. Lenders often prefer to see a solid business credit history when evaluating your application.

Mixing personal and business finances can hurt your credit score. You risk impacting both profiles if you default on payments tied to personal accounts. Keeping them separate helps maintain a clear picture of your business’s financial health.

However, if you attach a CPN profile that has been managed successfully with a 700 plus credit score as a personal guarantor to your company then this can provide many additional benefits.

Credit History Reflection

Tradelines provide insight into your business’s credit history. They reflect how you manage debt over time. For example, timely payments on vendor accounts improve your overall score. Late payments or defaults can damage it significantly.

Your Experian business credit scores depend on the information from these tradelines. A higher score indicates responsible financial behavior. This score influences lenders’ decisions about extending credit or funding.

You must regularly review your tradelines for accuracy. Errors can negatively impact your score and limit access to funds. Disputing inaccuracies ensures that lenders see a true representation of your creditworthiness.

Importance of Good Tradelines

Maintaining good tradelines is crucial for establishing trust with lenders. Strong tradelines indicate that you pay bills on time and manage debt responsibly. This reliability makes you a more attractive candidate for loans and lines of credit.

Good tradelines also open doors to better financing options. With a solid business credit profile, you may qualify for larger amounts at lower rates. This access allows you to invest in growth opportunities or cover unexpected expenses.

Additionally you may want to look into, “Projected income loan” For brand new businesses that don’t have a lot of activity but can still qualify for funding.

You should use our business vendor credit list (Available through our education and training that comes with your business filled out) to help build positive tradelines. Vendors that report to credit bureaus can boost your score when you make timely payments. Establishing relationships with these vendors is a strategic way to enhance your business’s financial reputation.

Benefits of Adding Business Tradelines for Sale

Enhanced Credit Profile

Adding Business Tradelines for Sale can significantly enhance your business credit profile. A strong credit profile shows that you manage debt responsibly. This is crucial for lenders and suppliers when assessing your business.

You can improve your credit score by incorporating positive Business Tradelines for Sale. Each new tradeline adds to your credit history, which can reflect well on your overall creditworthiness. A higher score opens doors to better financing options.

Many lenders look for businesses with a solid credit history, trade, and line. They often reward these businesses with lower interest rates. This means you will pay less over time. A good credit profile can also lead to higher credit limits, giving you more room to grow.

Better Financing Options

Improving your credit score through tradelines grants access to better financing options. Lenders are more likely to approve loans for businesses with high credit scores. This can be essential for funding expansion or managing cash flow with a business tradeline.

With a stronger credit profile, you may qualify for loans with lower interest rates. Lower rates mean reduced monthly payments. This can free up cash for other business needs, such as marketing or hiring staff.

You can also explore different types of financing. For instance, some lenders offer lines of credit specifically for businesses with excellent credit scores. These lines provide flexibility in managing expenses while keeping costs low.

Positive Vendor Relationships

Adding tradelines positively impacts vendor relationships and credit terms. Vendors prefer working with businesses that have a strong credit history. A good credit profile builds trust and confidence in your ability to pay.

When you establish solid relationships with vendors, they may offer better payment terms. For example, longer repayment periods or discounts for early payments become available in line.

How do I get tradelines on my business credit?

These benefits help you manage cash flow more effectively.

Moreover, having reliable vendors can improve your supply chain efficiency. When vendors trust you as a customer, they are more likely to prioritize your orders and provide better service. This leads to smoother operations and enhanced business reputation.

Credibility with Lenders

Establishing credibility with lenders is crucial for any business. By adding tradelines, you demonstrate your commitment to managing debt responsibly. Lenders appreciate seeing a track record of timely payments and low utilization rates.

Your credibility influences the types of financing options available to you. Lenders may offer larger loan amounts or more favorable terms if they see a solid credit profile. This can make a significant difference when seeking funds for growth initiatives.

Building credibility extends beyond just lenders. Suppliers and partners also take note of your business’s financial health. They are more inclined to enter into contracts or agreements if they see that you maintain a strong credit profile.

How Tradelines Boost Credit

Mechanics of Tradelines

Tradelines directly impact your credit score. Each tradeline represents an account listed on your credit report. This includes credit cards, loans, and mortgages. Lenders use these accounts to assess your creditworthiness.

Your payment history plays a significant role in this process. It accounts for about 35% of your FICO score. Timely payments improve your score, while late payments can damage it. A single missed payment can stay on your report for seven years. Therefore, maintaining a good payment history is crucial.

Credit utilization ratios also matter. This ratio compares your total credit card balances to your total credit limits. Ideally, you should keep this ratio below 30%. Lower utilization shows lenders that you manage credit responsibly. Adding tradelines with high limits can lower your overall utilization, boosting your score.

Importance of Payment History

Payment history is the most influential factor in determining credit scores. You need to make consistent, on-time payments to build a strong history. This shows creditors that you are reliable.

Each positive payment adds to your overall score. Conversely, one negative mark can significantly hurt it. For example, if you have a long history of on-time payments but miss one, it could drop your score by 100 points or more.

You should consider adding seasoned tradelines to enhance this aspect. Seasoned tradelines come from accounts that have been open for several years with a solid payment record. They provide immediate benefits by showing a long history of responsible credit use.

Role of Seasoned Tradelines

Seasoned tradelines demonstrate strong creditworthiness. These accounts often have a long history of on-time payments and low balances. They signal to lenders that you are a low-risk borrower.

When you add seasoned tradelines to your profile, you benefit from their established history. This can quickly elevate your overall credit score. For instance, if you add a seasoned tradeline with a $10,000 limit and no balance (Like provided with our financial business trade lines for sale above), it enhances both your credit utilization and payment history metrics.

Many borrowers see significant improvements in their scores after adding seasoned tradelines. Some report increases of 50 points or more within just a few months.

Diversifying Your Credit Profile

Multiple tradelines can diversify and strengthen your credit profile. Having various types of credit accounts improves your score over time. Lenders prefer seeing different kinds of accounts—like revolving lines and installment loans.

A diverse profile shows that you can manage various types of debt responsibly. It lowers the risk for lenders when considering you for loans or credit lines. For example, if you have only one type of credit account, lenders may view you as less experienced.

Adding multiple tradelines also helps spread out risk across different accounts. If one account has a late payment, others can still maintain good standing. This balance protects your overall score from drastic drops.

Choosing the Right Tradelines

Key Factors

You should consider several key factors when selecting tradelines for your business. First, look at the age of the tradeline. Older accounts typically have a positive impact on your credit score. They show a longer history of responsible payment behavior.

Next, evaluate the credit limit of the tradeline. A higher limit can improve your credit utilization ratio. This ratio is crucial for your overall credit score. Lenders often view high limits as a sign of good financial management.

Finally, assess how the tradeline aligns with your business goals. Consider how it fits into your broader credit strategy. Each account should contribute positively to your overall financial health.

Importance of Age and Credit Limit

The age of a tradeline plays a significant role in determining its value. Tradelines that are several years old can greatly enhance your credit profile. For example, a five-year-old account is more beneficial than a newly opened one. The older account demonstrates stability and reliability.

The credit limit also matters significantly. Accounts with high limits show lenders that you can manage large amounts of credit responsibly. This factor can lead to better loan terms in the future.

When analyzing potential tradelines, focus on both age and limit together. An old account with a low limit may not be as effective as a newer account with a high limit. Balance is essential in making the right choice.

Verifying Legitimacy

You must verify the legitimacy of any tradeline provider before making a purchase. Not all vendors are trustworthy. Some may sell fake or non-existent accounts that do not report to credit bureaus.

Research potential providers thoroughly. Look for customer reviews and testimonials online. A reputable company should have positive feedback from previous clients.

Ask for documentation showing that the accounts report to major credit bureaus like Dun & Bradstreet and Experian. Legitimate providers will have no issue providing this information. Protect yourself by ensuring you deal with credible vendors.

Assessing Impact

Assessing the impact of a tradeline on your overall credit strategy is crucial. You need to understand how each account will affect your credit reports and scores over time.

Start by calculating how adding a new tradeline will change your credit utilization ratio. If it lowers this ratio, it could increase your score significantly.

Monitor changes in your credit score after adding new accounts. Use tools available through various credit monitoring services to track these changes effectively. Regularly reviewing your reports helps you stay informed about your progress.

Incorporate tradelines strategically into your long-term financial plan. Consider how they can help you achieve specific goals, such as obtaining loans or securing better interest rates.

Free Tradelines You Can Use

Potential Sources

You can find free business credit summaries from various sources. Start by checking major credit bureaus like Equifax and Experian. They often provide free reports or summaries that can help you assess your current credit status.

Another option is to look for local banks or credit unions. Many of these institutions offer programs for small businesses. They might provide access to trade lines as part of their services. This could be a great way to build your business credit without incurring costs.

Online platforms also exist that aggregate information about tradelines. Websites focused on business credit may list companies willing to share tradelines at no cost. Researching these platforms can lead you to valuable resources.

Trade Credit Benefits

Using trade credit with suppliers offers significant benefits. This method allows you to purchase goods without immediate payment. It helps you manage cash flow effectively while building your credit history.

You will likely receive a Paydex score from suppliers when using trade credit responsibly. This score reflects your payment history and overall creditworthiness. A good Paydex score can open doors for future financing opportunities.

Maintaining good relationships with suppliers is crucial. Timely payments enhance your reputation, making it easier to negotiate better terms later. Suppliers often appreciate prompt payments and may offer additional benefits, such as discounts or extended payment terms.

Community Programs

Local organizations and community programs may assist in obtaining tradelines. Many chambers of commerce have initiatives aimed at supporting small businesses. They often provide resources, workshops, and connections to local suppliers willing to extend trade credit.

Non-profits focused on economic development sometimes offer assistance too. These organizations may help you connect with lenders or suppliers who provide favorable terms for new businesses.

Networking within your community can yield unexpected results. Attend local business events and engage with other entrepreneurs. You might discover hidden resources or partnerships that can benefit your business credit journey.

Leveraging Business Credit Cards

Using business credit cards responsibly can also help build your credit without extra costs. Choose cards that offer rewards or cash back on purchases you already make for your business. This way, you earn benefits while improving your credit profile.

Paying off the balance in full each month is essential. This practice helps avoid interest charges while positively impacting your credit score across all bureaus. Your timely payments will reflect well on your business credit summary.

Keep track of your spending and set limits based on your budget. Avoid overspending just because you have access to a line of credit. Responsible use of these cards demonstrates financial discipline, which lenders appreciate.

Avoiding Bad Tradeline Choices

Red Flags

You should be aware of several red flags when considering tradelines. First, check the seller’s reputation. If they lack reviews or have many complaints, proceed with caution. A good seller typically has a history of positive feedback from previous buyers.

Next, look for transparency. Sellers should provide clear information about the tradelines they offer. If they are vague or unwilling to share details, it raises concerns. You need to know exactly what you are buying.

Lastly, watch out for overly aggressive marketing tactics. If a seller pressures you to buy quickly, it may indicate a scam. Take your time and do thorough research before making any decisions.

Risks of Unverified Sources

Purchasing from unverified sources can lead to loss of funds.

You may end up buying tradelines that do not exist. It is essential to verify the legitimacy of any source before engaging in a transaction.

Unverified sources may not follow ethical practices. They might sell lines that could potentially harm your credit score rather than improve it. Always prioritize reputable sellers who provide verified information.

Understanding Terms and Conditions

Understanding the terms and conditions of tradelines is critical. Many sellers include complex clauses that can be confusing. You must read these documents carefully before agreeing to anything.

Look for specific details about fees, duration, and how the tradeline affects your credit report. Some terms may include hidden charges that can add up over time. Make sure you know what you are getting into.

If you find any unclear language, ask questions until you fully understand. A legitimate seller will be willing to explain their policies clearly. Don’t hesitate to seek help from professionals if needed.

Long-term Damage

Associating with bad tradelines can have lasting effects on your credit profile. Poor-quality lines may lead to significant drops in your credit score. This can affect your ability to secure loans or favorable interest rates in the future.

You might also face difficulties in obtaining new credit accounts if lenders see negative reports linked to your name. Over time, this can limit your financial opportunities and hinder your growth.

Moreover, trying to remove bad tradelines from your report can be a lengthy process. It requires persistence and sometimes professional assistance. The longer you wait to address the issue, the more entrenched it becomes in your financial history.

Common Misconceptions About Tradelines

Quick Fix Myth

You might think buying tradelines is a quick fix for your credit problems. This belief can lead to disappointment. Tradelines do not solve underlying issues like missed payments or high debt. They only add good history to your credit report.

Adding tradelines will instantly boost your scores. Credit scores that reflect your personally managed accounts improve gradually as you demonstrate responsible financial behavior over months and years. Relying on tradelines Will boost your score significantly but does not replace good habits with account management practices.

In reality, purchasing tradelines is one part of improving credit health. You must also focus on paying bills on time and reducing debt. Without addressing these core issues, any gains from tradelines may be temporary.

Not All Tradelines Are Equal

Another common misconception is that all tradelines provide the same benefits. This is not true. The quality of a tradeline matters significantly. Some accounts have higher limits and longer histories than others.

You should research each business tradeline before making a purchase. Look for factors like the age of the account and payment history. A seasoned tradeline from a reputable provider can offer more advantages than a newer one with a poor payment record.

Understanding the differences can help you make informed decisions. You want to choose tradelines that align with your specific credit goals. Focusing on quality over quantity will yield better results in the long run.

Seasoned Tradelines Guarantee Approval?

A widespread belief exists that seasoned tradelines guarantee loan approval. This idea is misleading. Lenders look at many factors when deciding whether to approve a loan or credit application.

Your income, existing debt, and overall financial profile play significant roles in this decision. Even with seasoned tradelines, lenders may still deny your application if other areas raise concerns.

Tradelines can enhance your profile but cannot replace solid financial standing. Relying solely on them can lead to frustration when loans are denied despite having good tradelines.

Tradelines Alone Cannot Build Strong Credit

Many people misunderstand how credit scores work. Some believe that simply having tradelines will build strong credit on their own. This belief overlooks critical aspects of credit management.

Building strong credit requires a combination of factors. You need to maintain low credit utilization, pay bills on time, and avoid excessive inquiries into your credit report. Tradelines contribute to your score but cannot substitute for good habits.

Consider this: If you buy a tradeline but continue to miss payments elsewhere, it won’t help much. Your overall credit health depends on multiple elements working together effectively.

Steps to Purchase Tradelines

Research Providers

You must start by researching reputable tradeline providers like LNCF. Look for companies with a solid reputation in the market. Use online search engines to find providers. Check their websites for information about their services as well as our business trade lines for sale above.

Visit forums and social media groups related to tradelines. These platforms often have discussions about various providers. You can gather insights from other customers’ experiences. Pay attention to any red flags mentioned by users.

Look for providers that have been in business for several years. Longevity often indicates reliability. Verify if they are members of any professional organizations. This can further confirm their legitimacy.

Review Testimonials

Customer testimonials play a crucial role in your decision-making process. They provide firsthand accounts of others’ experiences with the provider. Read both positive and negative reviews to get a balanced view.

Focus on feedback regarding customer service, delivery time, and effectiveness. If many customers report issues, consider it a warning sign. High ratings across different platforms usually indicate a trustworthy provider.

Evaluate Costs

Evaluating costs is vital before purchasing tradelines. Prices can vary significantly among providers. Some may charge a premium for high-quality tradelines, while others might offer lower prices for less effective options.

Make sure to compare what each provider offers for their price. Understand what you are paying for, including account age and credit limits. Ask about any hidden fees that may not be immediately obvious.

Costs should align with your budget and financial goals. Avoid providers that seem too cheap, as this could indicate poor quality. A reasonable price typically reflects the value of the tradeline being offered.

Understand Terms

Understanding the terms of purchase is essential before making a commitment. Each provider will have specific guidelines and conditions attached to their tradelines. Read all terms and conditions carefully.

Pay attention to how long you will be able to use the tradeline. Some providers allow short-term access, while others offer longer durations. Knowing this helps you plan your credit strategy effectively.

LNCF Business trade lines stay on indefinitely.

Check the refund policy as well. In case the tradeline does not perform as promised, a clear refund policy protects your investment. Understanding these details helps prevent misunderstandings later on.

LNCF has a money back guarantee with all business trade lines for sale.

Building Credit Without Tradelines

Establishing Credit

You can build business credit without relying on tradelines. Start by focusing on responsible financial practices. This means paying your bills on time. Timely bill payments positively impact your business credit score.

Managing your debts effectively is also crucial. Keep your debt levels low compared to your available credit. This helps maintain a strong business credit rating. Your payment history accounts for a significant part of your business credit report.

Establishing credit accounts early can aid in building a solid foundation. Open accounts with suppliers who report to business credit bureaus. This way, you create a positive credit history that lenders can see.

When you become a business client of ours check out:

Vendor Relationships

Building relationships with vendors is essential for establishing business credit. Vendors often provide trade credit, allowing you to buy now and pay later. These relationships can lead to better payment terms and increased credit limits over time.

You should choose vendors who report to the major business credit bureaus. This increases the chances of your timely payments reflecting on your business credit reports. Strong vendor relationships can also lead to favorable financing options down the road.

Consider reaching out to local suppliers or service providers. They may offer flexible payment terms that can help you build your credit history. These partnerships often lead to mutual benefits as both parties grow together.

Utilizing Business Credit Cards

Using business credit cards is an effective strategy for building business credit. You can apply for a card designed specifically for businesses. These cards often come with benefits tailored to meet business needs.

Make small purchases regularly on your business credit card. Pay off the balance each month to avoid interest charges. This practice demonstrates responsible usage and builds a positive business credit history.

Business credit cards offer rewards programs. You earn points or cash back for every dollar spent. This not only helps in managing expenses but also contributes positively towards your business credit score.

Monitoring Your Progress

Regularly check your business credit reports to monitor progress. Understanding how your actions affect your scores is vital. Look for discrepancies and address them quickly.

You can obtain free copies of your reports from major business credit bureaus once a year. Review these reports thoroughly. Ensure all information is accurate and reflects your timely payments.

Consider using tools that alert you about changes in your business credit score. Knowing when updates occur allows you to take action if necessary. Staying informed empowers you to maintain a strong business credit profile.

Final Remarks

Navigating the world of business tradelines can be a game-changer for your credit strategy. You’ve learned how to select the right tradelines, the benefits they bring, and how to avoid pitfalls. With the right approach, you can enhance your credit profile and open doors for better financing options.

Take action now. Explore the options available to you and consider integrating tradelines into your business strategy. Empower yourself with knowledge and make informed decisions that can elevate your financial standing. Your credit journey starts today—don’t wait!

Frequently Asked Questions

What are Business Tradelines for Sale?

Business tradelines are credit accounts associated with a business. They help establish and build a company’s credit history, which can improve access to loans and favorable terms.

How do Business Tradelines for Sale benefit my business?

Tradelines enhance your business credit score, making it easier to secure financing. They also improve your credibility with lenders and suppliers, leading to better payment terms.

Can I purchase tradelines?

Yes, you can buy Business Tradelines for Sale from reputable sources like us here at LNCF. Ensure you research the provider to avoid scams and ensure the tradelines will positively impact your credit.

Are there free tradelines available?

Organizations offer free tradelines, such as certain business credit cards or vendor accounts. However, these may have limitations compared to paid options.

How long does it take for Business Tradelines for Sale to affect my credit?

Tradelines typically reflect on your credit report within 30 days of being added. The impact on your score varies based on several factors, including the account’s history.

Can I build credit without using Business Tradelines for Sale?

Yes, you can build credit through responsible use of business loans, credit cards, and vendor accounts. Timely payments and maintaining low debt levels are crucial for improving your credit score.

Legal New Credit File

The legal team at TMMinistry of Civil Affairs© PMA A/K/A LNCF Stands as a beacon of hope for the traditional consumer. Comprising a dynamic association of members who operate as Attorneys-in-Fact for our PMA registered members, each brings a unique blend of expertise, passion, and dedication to the table.

With backgrounds in corporate law, civil rights, and criminal defense, they offer comprehensive legal services that cater to everyday people. Their mission is to provide legal clarity about consumer privacy while upholding the values of integrity, transparency, and client-focused service.

Since its inception, LNCF has made significant strides in the legal community, earning trust for their innovative approach to complex contract challenges in the privacy space.

The team’s collaborative spirit is the cornerstone of their success, allowing them to leverage their individual strengths in a unified strategy. Whether navigating high-stakes client transitions or offering in-depth consulting services, they remain committed to making a positive impact in the lives of their clients and the broader American community.