Table of Contents

ToggleBUILD YOUR BUSINESS WITH US!

Sit back and watch as we handle your 45 business build-out tasks every day.

AN Urgent Message For: Entrepreneurs

Now, for the first time ever, starting a business has never been easier, with all necessary startup compliance requirements and many additional services provided in one place.

The crucial decision remains…

Would you prefer to embark on a challenging, costly, and unpredictable journey that might not succeed, or opt for a streamlined path to develop your business confidently alongside a partner committed to realizing your vision every day?

What your about to see below has NEVER be provided by another company online. The reason? It demands genuine effort and unwavering commitment to accomplish all tasks.

This service will NOT be found anywhere else!

Our dedication is unmatched, fueled by a fervent desire to see others succeed in leaving a legacy in their path.

Here's just a glimpse of the included benefits: ⬇️

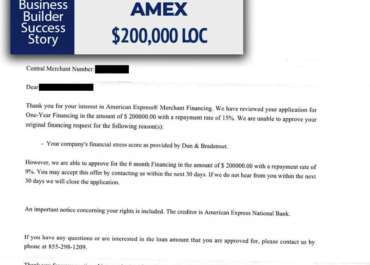

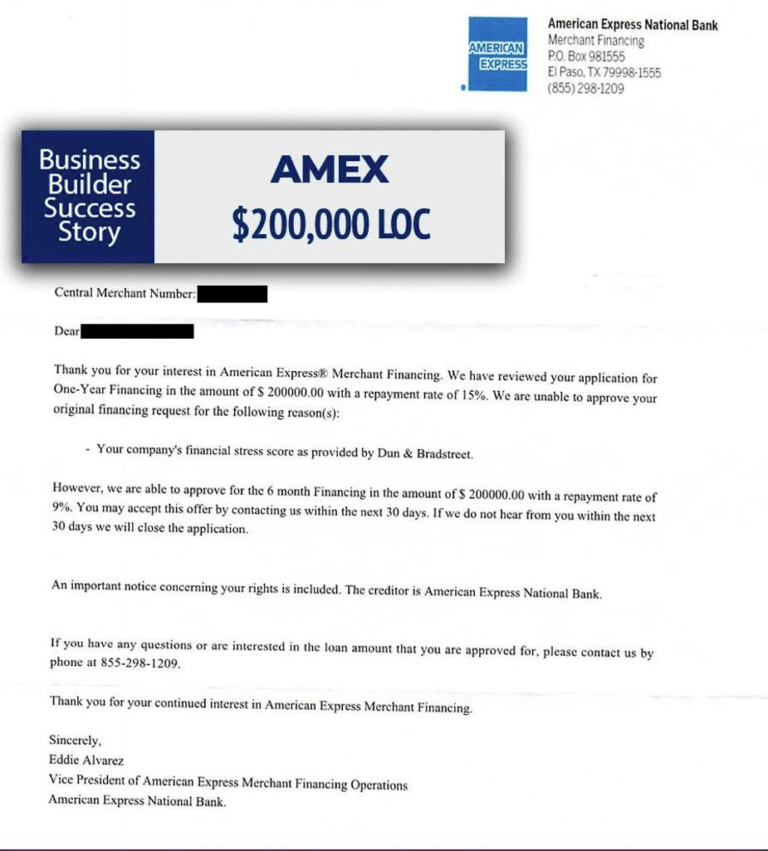

- Business Lines of Credit with up to 50% balance transfers directly to your bank account

- 0% Interest Cash Loans for 12 to 18 months, allowing you to invest and grow with free capital

- Projected Income Loans for new businesses, up to $120,000

- 2 to 3 Times Higher Credit Approvals than personal credit accounts typically offer

- Flexible Use of Funds—spend the money on any purpose you see fit

- Legal Protection—it’s illegal to be denied credit on your business pursuant to 15 USC 1691

- Turnkey Business Solution—relax while we handle every detail of your business build-out for you

You can legally establish a Secondary Personal Guarantor separate from your SSN personal credit profile With a 750 plus credit score and $150,000 in open credit reporting if you have bad personnel credit (scores under 650)

Did you know:

-

Small Business Loans:

The Small Business Administration (SBA) guarantees loans, making it easier for startups to secure funding. In 2023, the SBA backed loans totaling over $28 billion.

-

Growing Entrepreneurial Support

Over 7,000 business incubators and 200 accelerators worldwide offer mentorship, workspace, and funding to startups.

-

Government Grants:

There are numerous federal and state grants available, such as the Small Business Innovation Research (SBIR) program, which offers up to $1 million in funding for startups engaged in technological innovation.

-

Flexible Working and Lifestyle

Autonomy: Entrepreneurs enjoy the flexibility of setting their own hours, choosing projects, and building a company culture that aligns with their values.

-

Small Business Impact:

Small businesses make up 99.9% of all U.S. businesses, highlighting the vast market and the potential for growth.

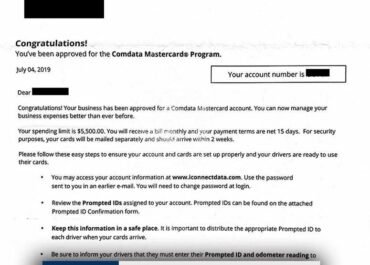

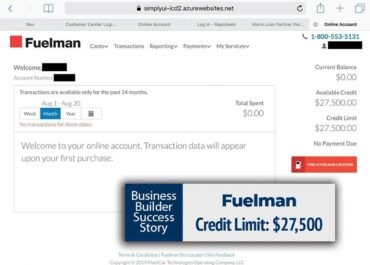

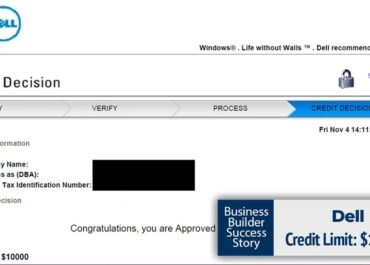

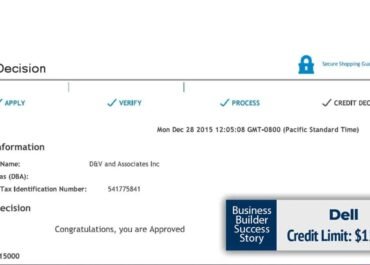

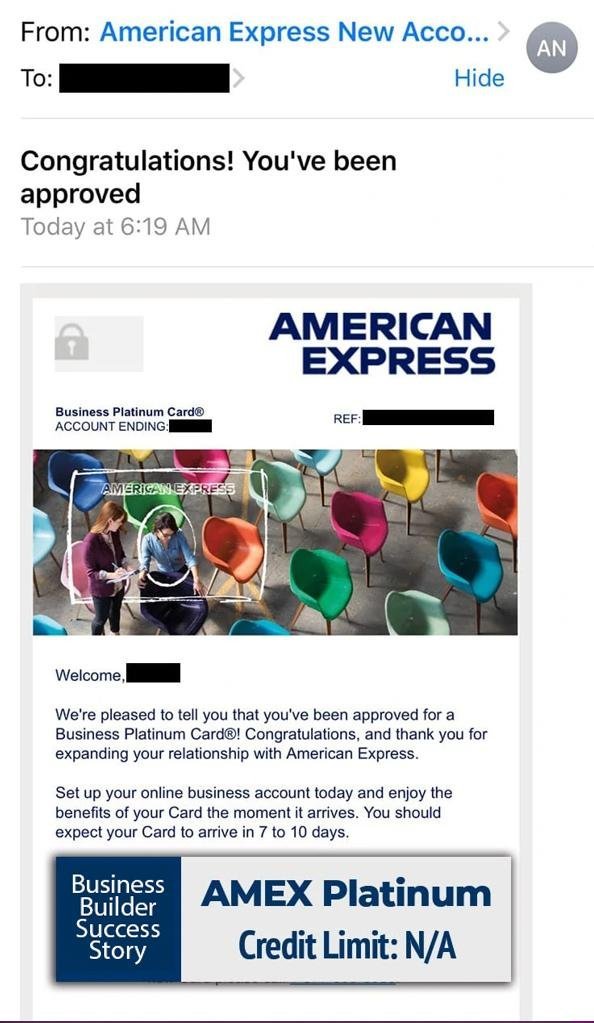

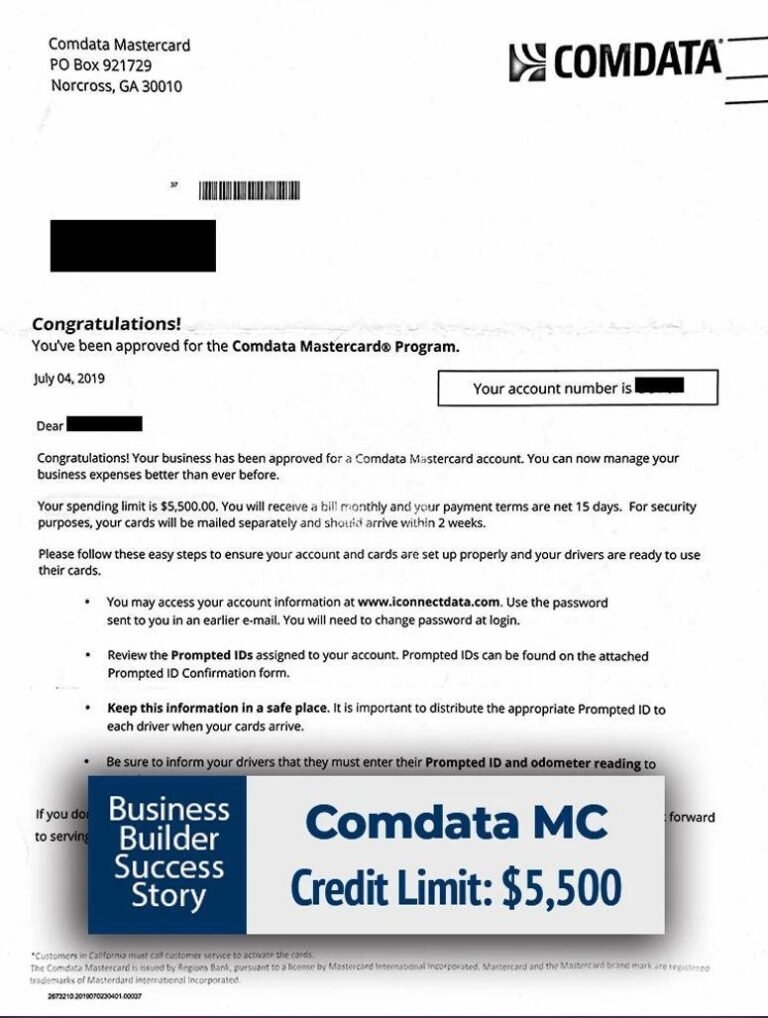

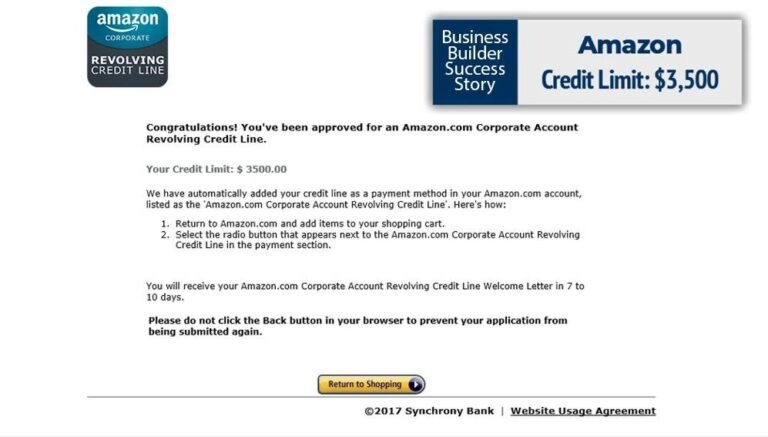

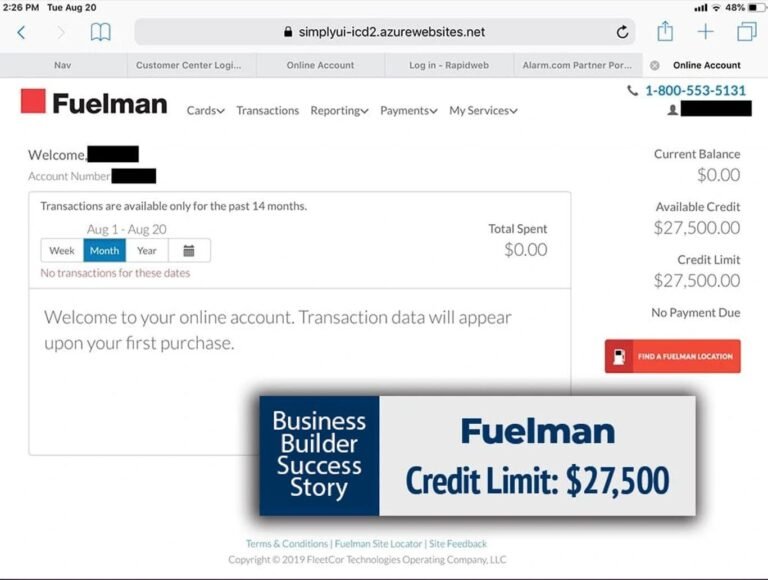

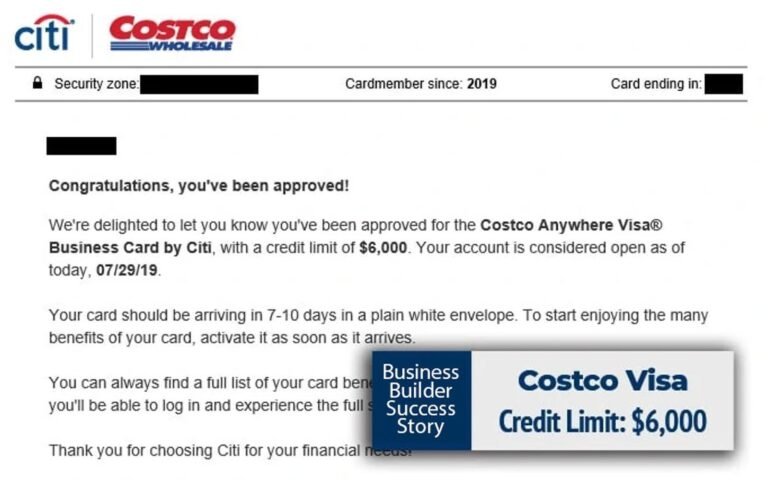

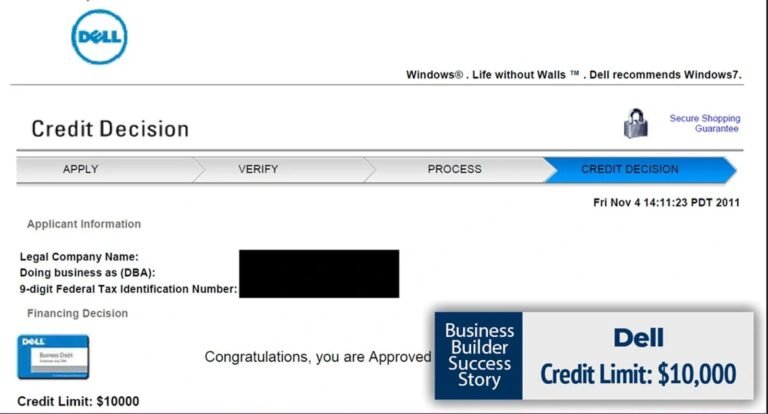

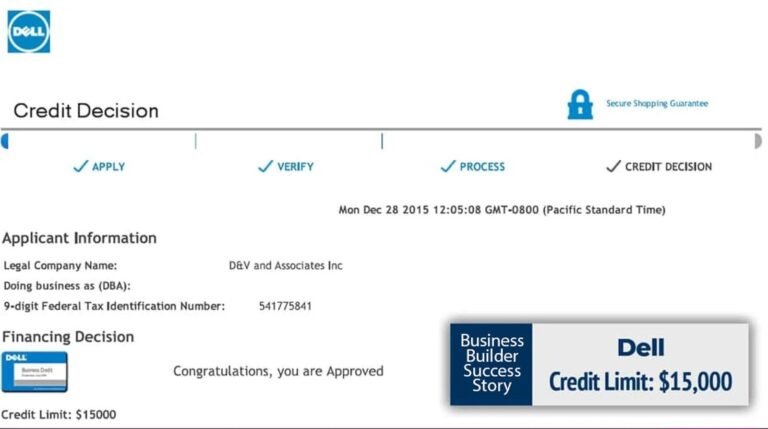

Are You Ready for Business Credit Approvals?

Our proven program has worked for many business owners and it can work for you as well.

our team has been been helping businesses grow for over a decade!

BUILD BUSINESS CREDIT WITH US!

Take Full Command of Your Credit Destiny

- Personal Credit Mastery: Create and manage your own primary tradelines

- Business Credit Authority: Build corporate credit profiles with full control

- No Third-Party Dependencies: Direct access to credit reporting systems

- Unlimited Flexibility: Post, modify, and optimize tradelines on your schedule

- Complete Transparency: Full visibility into every step of the process

TOTAL TURNKEY BUSINESS SOLUTION!

- The features and services we offer below CANNOT be found anywhere else on Earth!

- We dare you to find anyone providing all of the inclusive services we offer below.

WE PAY ALL YOUR STARTUP COSTS!

- By covering our service charge, you empower us to manage every aspect of your business setup process, including registrations, regulatory compliance, and payments for all necessary services. This enables you to concentrate fully on your company’s mission.

WE MAKE YOU LOOK GREAT ON PAPER & ONLINE!

Already have a business with just the basics set-up?

No problem! Save $500 on an established business.DO YOU NEED TO:

- ✅Have Us Pay the Business Startup Fees:

Let us handle and pay for all the essential registrations and account setups, so you can seamlessly step into the driver’s seat as a business owner. - ✅Fund Your Payroll:

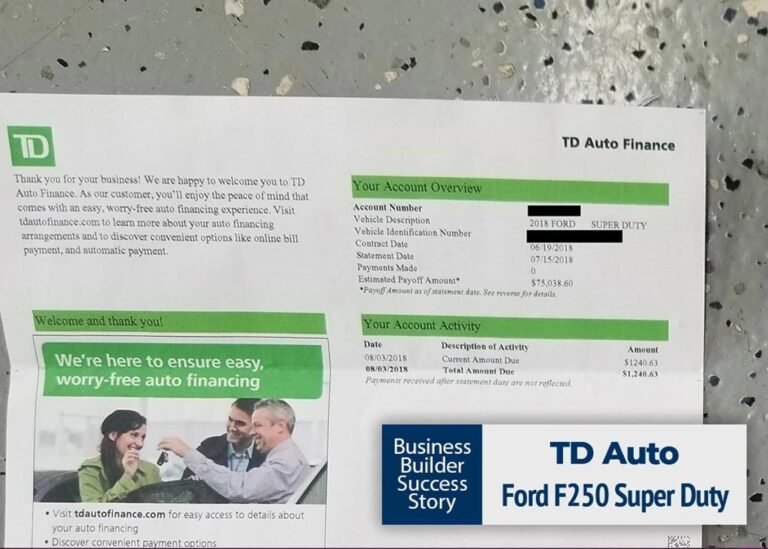

Ensure your team is compensated on time while you focus on growth, with financing options tailored to your needs. - ✅Finance Equipment and Production Assets:

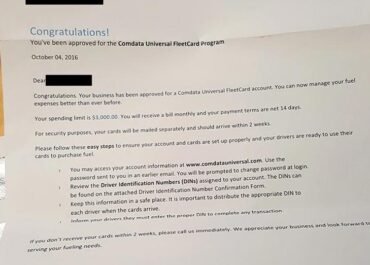

Access the capital you need to acquire essential equipment and assets, enabling seamless production and operations. - ✅Receive High-Limit Credit Cards:

Obtain high-limit credit cards designed to cover all your business needs, giving you the flexibility and purchasing power you require. - ✅Discover and Leverage Multiple Lines of Credit:

Explore various credit lines and learn how to strategically leverage them to maximize your business’s financial potential. - ✅Help Advertising and Running Marketing Campaigns:

Fuel your business growth with targeted advertising and marketing campaigns, all supported by the right location and demographic. - ✅Step-By-Step Business Grants:

Navigate the world of business grants with our detailed guidance, including personalized letters and instructions to secure the funding you deserve. - ✅Invest in Real Estate:

Diversify your business assets by investing in real estate, supported by strategic financial planning. - ✅

Help Registering for the Corporate Transparency Act (CTA, BOI):

NO LONGER REQUIRED AS OF DEC 3RD 2024 LINK

UNLOCK THE POWER OF BUSINESS CREDIT TO

PROPEL YOUR BUSINESS TO NEW HEIGHTS

Imagine building a credit profile exclusively for your business, independent of your personal credit. With business credit, your company establishes its own credit history and score, opening the door to higher-tier credit opportunities that fuel growth and expansion.

We’re here to guide you through every step, ensuring you meet the specific underwriting requirements that lenders and credit issuers demand. With our expertise, you can secure approvals tailored to your business’s unique legal standing and EIN, no matter where you are on your journey.

Even if personal credit challenges are holding you back, we offer innovative solutions like No Personal Guarantee (No PG) credit options. Plus, we can establish a Hybrid Credit Privacy File (CPF) as a PG on your new corporation, safeguarding your personal SSN credit file for retirement and beyond.

Our support doesn’t stop there. We help you lay the foundation for robust business credit with 1st tier Trade Line Approvals and 2nd tier Business Credit Cards—all based on your business credit alone.

No matter your background or business type, our business advocacy program equips you with everything you need to secure the funding necessary for growth and success.

Remember, your business is unique, and so is the corporate credit strategy we design for you. It’s time to build the credit that will take your business to the next level.

NEED TO ESTABLISH LIABILITY

PROTECTION ON THE PERSONAL GUARANTOR?

We can register a secondary credit number with the IRS to use as the Personal Guarantor that has a 700+ FICO score.

You will have Triple the borrowing power since your SSN credit will be separate from your Credit Privacy File / PG’s business credit & PAYDEX© Profile.

Your company has an individuality that sets it apart from every other business on your street, in your town, and around the world.

- You want to establish a Business Credit PAYDEX© Score ASAP!

- You need a strategy that gets your company the credit it deserves while reducing personal liability legally.

- You deserve one-on-one attention that addresses your specific goals from a team that has helped establish and build business credit successfully with many successful businesses over the years.

- You can have confidence in our specialized training and experience. You don’t want to take a chance on spending a lot of time and a lot of money on a business build out only to realize the business was set up the wrong way for your needs.

- You get private group support plus the following foundational services and documents

WHAT ELSE DO WE DO FOR YOU?

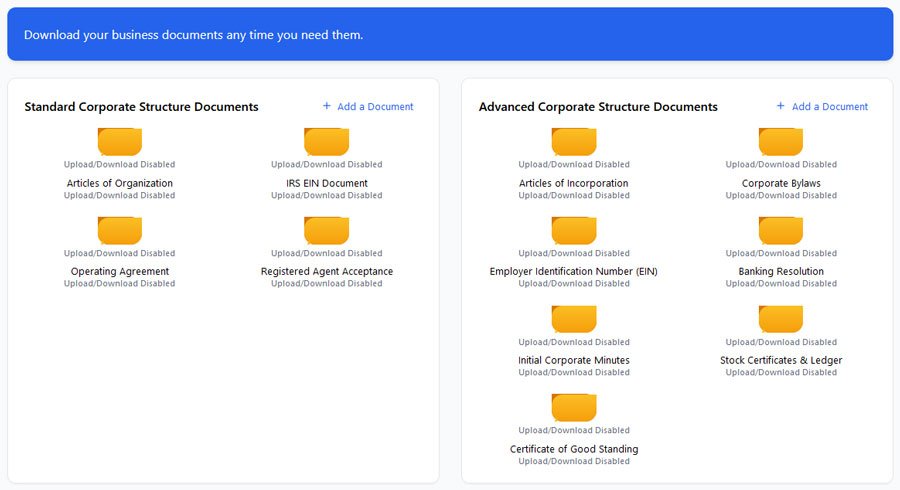

We provide comprehensive services tailored to your business structure, whether you’re establishing an LLC or a Corporation. Below is a breakdown of what we offer:

LLC Services

✅ Expedited LLC Filing – Fast-track your Articles of Organization to establish your business entity.

✅ Registered Agent Services – We handle legal and compliance documents on your behalf.

✅ LLC Membership Certificates – Proof of ownership for each member in your LLC.

✅ Articles of Organization – Official documentation outlining your LLC’s formation and structure.

✅ Employer Identification Number (EIN) Document – A printable PDF for banking and tax purposes.

✅ Operating Agreement – A legally binding document defining the rules and roles within your LLC.

✅ Online Notary Credit – For operating agreements requiring notarization.

Corporation Services

✅ Expedited Corp Filing – Immediate submission and processing of Articles of Incorporation.

✅ Registered Agent Services – Ensure legal notices are received promptly and securely.

✅ Corporate Bylaws – Internal governance rules guiding the operation of your corporation.

✅ Articles of Incorporation – The foundational document filed with the state to create your corporation.

✅ Stock Certificates & Ledger – Proof of stock ownership and tracking of shareholder activity.

✅ Banking Resolution – Authorizes corporate officers to open and manage business accounts.

✅ Initial Corporate Minutes – Documenting the corporation’s first official meeting.

For Both LLCs & Corporations

✅ Annual Worry-Free Compliance – Stay on top of annual reports, filings, and renewals.

✅ Commercial Address on Business Filings – A professional address to maintain privacy and credibility.

✅ Business Mail Forwarding – Handle your business correspondence efficiently.

✅ Business Documents Library – Secure access to your official documents anytime.

YOUR SERVICE ALSO INCLUDES:

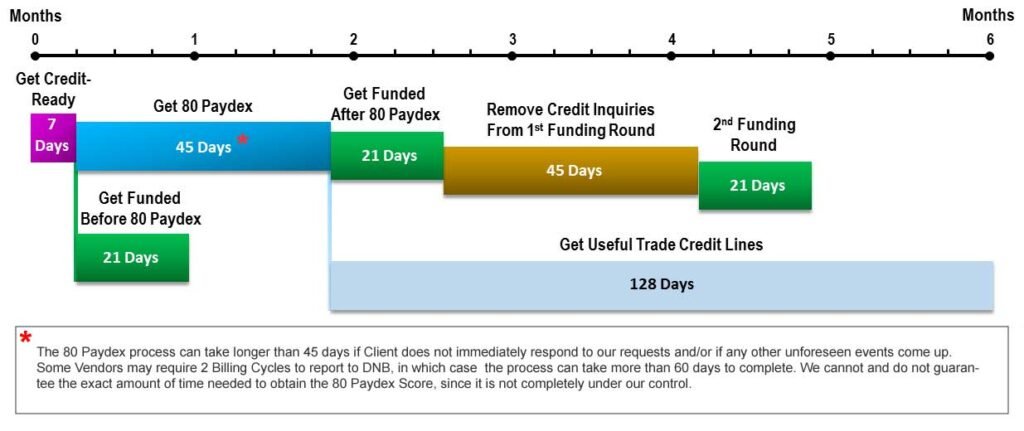

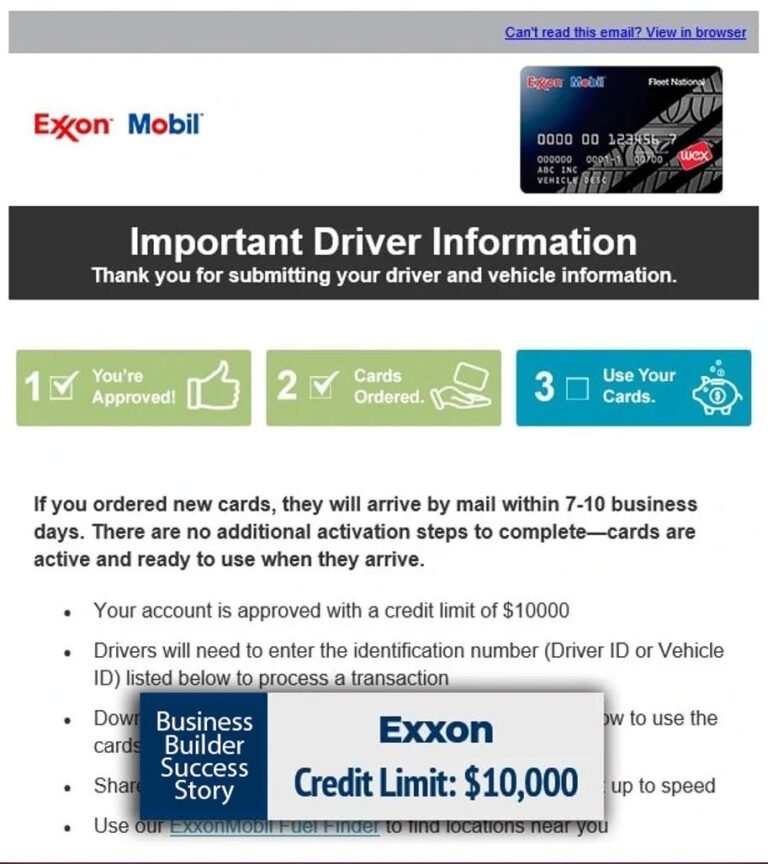

- ✅Complete all public commerce procedures To effectively post Your Business Credit Score & get you Business Funding up to $10,000 in as soon as 5-weeks from service start date *Restrictions apply

- ✅Register Business with all necessary agencies per company CTA/SIC/NAICS designation with low risk score ($500 value)

- ✅We pay: We cover all Secretary of State filing fees, domain name, hosting, business listings, 800 number, business address, registered agent service, business logo, and social media setups ($600 value).

- ✅Up to 1,500-word approved press release for distribution to over 420 premium news outlets, allowing you to feature ‘As seen on’ news citations on your website and advertising, including CBS, FOX, etc. ($300 value) (Buy separate HERE)

- ✅500+ Public Records Business Listing Submissions with user/pass Excel Sheet (local citations will improve your Local Business search ranking, Geo-tag approved image on Every listing ($150 value)

- ✅Up to (6) Business Social Media Accounts, Profile image & cover, Website integration, Action plan ($120 value)

- ✅Business Niche Keyword Research with Competitor Analysis so you know exactly what you need to out rank your competition local or national ($200 value)

- ✅Professional Business Domain & Email Service setup ($50 value)

- ✅Custom website with up to 12 pages (or additional pages for existing websites, such as professionally written articles), including design, maintenance, redesign, and page tuning assistance ($1,200 value).

- ✅NEW What good is a website without traffic? You also get our Traffic Booster Package with white hat Off-Page SEO, which includes a total of 4,500 backlinks (900 Tier 1 backlinks and 3,600 Tier 2 backlinks), up to 10 keywords, 100% DoFollow backlinks, permanent backlinks, premium indexing, and a detailed report. Need it for another site? Buy separately for $250 HERE)

- ✅Create approved Professional Modern Business Logo Concepts + Jpeg and PNG file with 3 revisions ($125 value)

- ✅Additional 500+ Premium Google safe targeted keyword Back-links from high domain authority websites to easily rank your website with exclusive link indexer ($150 value)

- ✅Advanced SEO Tactics – Excel 245 point checklist ($250 value)

- ✅Proper DUNS Registration and SBSS Connect

- ✅Business Bank Accounts Curated Approval List

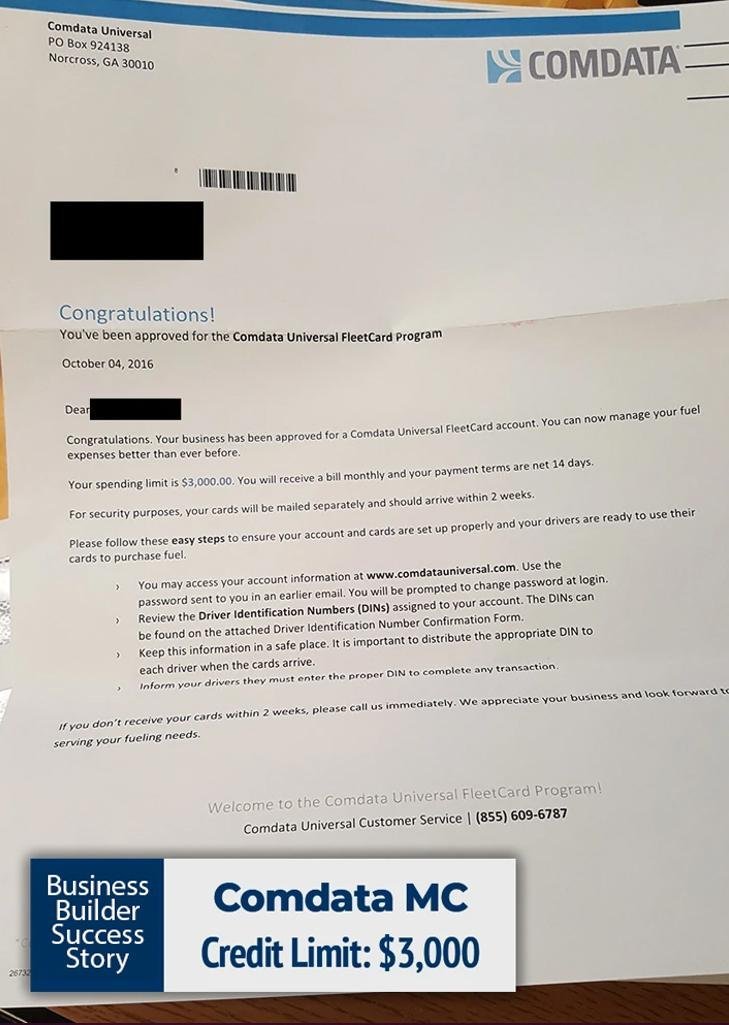

- ✅Options for industry-specific trade accounts that will suit your company’s needs

- ✅Instructions and assistance throughout the credit-building process

- ✅Provide the required website Privacy Policy and Terms and Conditions legal documents/pages to get your credit card processing approved and engage legally in commerce.

- ✅Help you obtain five Tier 1 and five Tier 2 Net Trade Accounts.

- ✅PG / non PG curated credit issuers list

- ✅NEW BONUS! Business Grants Step-By-Step with letters & instructions or Grant Writing Service (We do it for you, Extra) Download Proposal HERE

- ✅Help getting you Funding!

BONUS! EDUCATION & RESOURCES THAT ALSO COME WITH THIS PACKAGE BELOW:

- ✅LNCF – THE SECRET TO WEALTH Volume #1 – Establish Your Business Advanced Methods (68 pages) The Credit, Banking, & Asset Secrets of the Elite

- ✅LNCF – THE SECRET TO WEALTH Volume #2 – Advanced Business Credit Step-By-Step (92 pages) How to Build $50K+ in Business Credit

- ✅Extra Bonus Guide: “9 Steps to Getting up to 100K in Funding in 90 Days”

- ✅CDFI Business Lenders List 2024

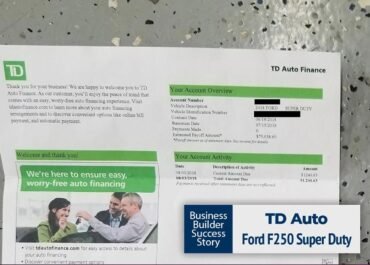

- ✅Auto Loan In Business Name Method

- ✅Equipment Financing List

- ✅(NO PG) Business Credit Accounts List

- ✅(NO PG) Business Credit Cards List

- ✅Vehicle Financing Lenders List

- ✅Business Accounts Status & Approval Tracker

- ✅1000 LENDERS LIST + Gov Grants List

- ✅Corporate Transparency Act Ready (CTA, BOI) PDF

UP TO 12 PAGE WEBSITE READY FOR SALES

current example of A website we built for one of our clients

TOTAL SERVICE COST:

Already have a business? Get $500 off the price below! Ask us how…

🚀START BUILDING NOW!

ALSO INCLUDED!: The most universal bundle of business intelligence, secret strategies, proven copies, guides, and ready-to-use templates from the World's leading organizations and individuals.

Dear Aspiring Entrepreneur,

(3) decades ago, we all embarked on our entrepreneurial journey.

It was a rollercoaster of highs and lows, triumphs and setbacks, with plenty of unsolicited advice from the sidelines.

Along the way, we encountered a pivotal realization: our initial lack of proper knowledge was a significant barrier to our success.

Understanding the essentials was not just an obstacle we had to overcome; it was the cornerstone of our business achievements.

We learned to work hard, but the real game-changer was learning to work smart—a concept we initially knew nothing about.

Driven by a curiosity to uncover the secrets of successful entrepreneurs, we dove  deep into the world of business.

deep into the world of business.

Countless hours later, we mastered website building, leveraged advanced SEO strategies, navigated the complexities of business registration, and decoded the essentials of fast-tracking business credit—all crucial skills that propelled our ventures.

After creating several multimillion-dollar businesses and briefly flirting with retirement, we realized our true passion lies in the throes of entrepreneurship. We decided to compile our wealth of knowledge into a comprehensive, done-for-you business startup package designed to eliminate the guesswork for fellow entrepreneurs.

After creating several multimillion-dollar businesses and briefly flirting with retirement, we realized our true passion lies in the throes of entrepreneurship. We decided to compile our wealth of knowledge into a comprehensive, done-for-you business startup package designed to eliminate the guesswork for fellow entrepreneurs.

Imagine having a polished, profit-ready business setup waiting for you, complete with a fully optimized website, advanced SEO, business listings, press releases, and much more. Our package also includes vital market insights and social media setup, ensuring you’re primed for credit approvals and poised for success in your desired niche.

Presenting our Business Credit Build Out Package—your all-in-one solution to launching a successful business, backed by our proven methods and insider knowledge.

Hearing feedback like, “I am highly grateful for your dedication and service to our vision,” fuels our commitment to transforming our clients’ dreams into reality, often turning them into lifelong friends.

Hearing feedback like, “I am highly grateful for your dedication and service to our vision,” fuels our commitment to transforming our clients’ dreams into reality, often turning them into lifelong friends.

We’re more than just a service; we’re a community passionate about empowering small businesses. Whether you’re rekindling your entrepreneurial spirit or sketching out business plans over coffee, we’re here to guide, mentor, and support you.

Why not reach out? At worst, you’ll gain invaluable insights with no strings attached—a win in our book. Plus, we relish any opportunity to talk shop. Beyond the financial rewards, helping others succeed is the most exhilarating experience we’ve discovered.

May your entrepreneurial path be blessed,

Your Serial Entrepreneur Team,

LNCF

“I just have to say I am highly grateful for your dedication and service to my vision sir. It means more than I can express through an email, phone call or text, not only to me but my family and those I consider family as well 🫡🙏🏾🫱🏼🫲🏾🍾📑”

“I just have to say I am highly grateful for your dedication and service to my vision sir. It means more than I can express through an email, phone call or text, not only to me but my family and those I consider family as well 🫡🙏🏾🫱🏼🫲🏾🍾📑”

Date of experience: 2023-01-15

“Thanks! We plan on retaining LNCF as our private business/financial mentor & resource hub. I foresee the next 1 or 2 years working closely and aggressively with you to build & scale multiple businesses… I also want to broker some if not most of the services LNCF offers since service reliability is important to my network 🫱🏼🫲🏾”

“Thanks! We plan on retaining LNCF as our private business/financial mentor & resource hub. I foresee the next 1 or 2 years working closely and aggressively with you to build & scale multiple businesses… I also want to broker some if not most of the services LNCF offers since service reliability is important to my network 🫱🏼🫲🏾”

F.J. Founder & CEO | Date of experience: 2023-9-25

“Thank you. Everything looks goods. Please proceed with the Public records submission. I look forward to doing business with you in the future. You guys are very professional. Thank you again.”

“Thank you. Everything looks goods. Please proceed with the Public records submission. I look forward to doing business with you in the future. You guys are very professional. Thank you again.”

J.W. Date of experience: Jan 25, 2023

Important Business Build-Out Disclosures

Please review the following information about our business build-out services, fees, and policies.

You can trust your brand with us regardless of the type of business you want or have. Here is a brief description of some of the services that we offer to our clients below:

(the list below is also great for SEO 🙂 )

Startup Funding

Startup Funding for Business

Startup Funding for Small Business

Startup Funding Website

Start-up Funding For Nonprofits

Startup Funding Companies

Startup Funding Options

Startup Funding Sources

Startup Funding Stages

Startup Funding Online

How Startups Get Funding

Business Funding

Business Funding For Startups

Business Funding Solutions

Business Funding With Bad Credit

Business Funding Fast

Small Business Funding

Business Funding Partners

Business Funding For Veterans

Business Funding Group

Startup Funding Capital

Small Business Loans

Small Business Loans For Woman

How to Get Small Business Loans

Small Business Loans for Startup

Small Business Loans for Veterans

Small Business Loans Rates

Small Business Loans Near Me

Rates for Small Business Loans

Small Business Loans for Minorities

How Do Small Business Loans Work

Small Business Loans New Business

Small Business Loans Online

Small Business Loans for Disabled Veterans

Qualifications for Small Business Loans

Small Business Loans Unsecured

Where to Get Small Business Loans

Small Business Loans Quick

Small Business Loans Companies

Small Business Loans Amount

Unsecured Loans

Unsecured Loans Personal

Unsecured Loans vs Secured

Unsecured Loans for Business

Unsecured Loans Online

Unsecured Loans Debt Consolidation

Unsecured Loans to Consolidate Debt

Unsecured Loans Rates

Rates for Unsecured Loans

Unsecured Loans Near Me

Unsecured Loans Interest Rates

Unsecured Loans for Veterans

Unsecured Loans Types

Unsecured Loans Best Rates

Unsecured Loans Low Interest

Unsecured Loans Companies

Creative Financing

Creative Financing Options

What is Creative Financing

Creative Business Financing

Creative Financing Ideas

Creative Financing Strategies

Creative Financing Solutions

Real Estate Investor Loan

Real Estate Investor Financing

New Venture Funding

Secured Loans

Secured online loans

Secured Loans for Bad Credit

Secured Loans with Bad Credit

Secured Loans for Business

Secured Loans vs. Unsecured Loan

Secured Loans Rates

How Does Secured Loans Work

Secured Loan Debt Consolidation

Secured Loan Collateral

Secured Loans Types

Start-up Business Loan (Bad Credit Rating)

Start-up Business Funding

Business Funding for Startup

Startup Business Loan Rates

How to apply for Startup Business Funding

SBA Loans

SBA Loans Requirements

SBA Loans Rates

SBA Loans (504)

SBA Loans Disaster

SBA Loans for Veterans

SBA Loans for Woman

SBA Loans Business

SBA Loans Interest Rate

Terms for SBA Loans

SBA Loans Real Estate

SBA Loans Types

SBA Loans for Small Business

SBA Loans Programs

SBA Loans Applications

MCA Loans

MCA Business Loans

Merchant Cash Advance

Merchant Cash Advance Companies

Merchant Cash Advance Loan

What is Merchant Cash Advance

Merchant Cash Advance Bad Credit

Shark Loans

Shark Loans Online

Shark Loans and Bad Credit

Funding for Companies

Funding Companies

Funding Companies for Startups

Funding for Small Companies

Business Lines of Credit

Lines of Credit for Business

Lines of Credit Loans

Lines Credit Personal

Lines of Credit for Small Business

Lines of Credit Online

How do Lines of Credit Work

Equity Lines of Credit Rates

Lines of Credit Rates

Interest Rates for Lines Credit

Lines of Credit vs. Loan

How to Get Lines of Credit

Business Lines of Credit Rates

Apply for Lines of Credit

Lines of Credit Loans for Bad Credit

Lines of Credit for New Business

Lines of Credit for New Businesses

Lines of Credit on Investment Properties

Business Lines of Credit Interest Rates

Lines of Credit Basics

Best Personal Lines of Credit

How Line of Credit Work

How to Get the Funding for a Business

How to Get Funding to Start a Business

How to Get Funding for Startup

Best Funding Options

Entrepreneur Funding

Funding for Entrepreneur

Social Entrepreneur Funding

Business Capital Loan

Capital for Small Business

Working Capital for Small Business

Small Business Funding

Small Business Funding for Startups

Small Business Funding StartUp

Small Business Funding Options

How to Get Small Business Funding

Small Business Funding Companies

Business Credit Line

Business Credit Builder

How to Build Business Credit

Funding for Startup Business

Funding for Entrepreneurship

Funding for Startup Nonprofits

Funding for Startup Restaurants

Funding for Social Entrepreneurs

Funding for Tech Startup

Funding for Female Entrepreneurs

Funding for My Startup

Restaurant Funding

Funding for Restaurant Startup

Funding for Gyms

Financing a Yoga Studio

Funding for Fitness Programs

David Allen Capital

Fundwise Capital

Business Credit Hashtags:

#businessloan #businesscreditcard #businessloans #businessfinance #corpay #businescreditcards #businesscreditrocks #businesscreditbuilder #businesscredit #businesscreditscores #buildbusinesscredit #creditrepair #creditrepairworks #creditrestoration #businessscan #businessfinancing #businessfinancingsolutions #businessfunding #workingcapital #workingcapitalloans #workingcapitalloan #workingcapitalforsmallbusinesses #getapprovednow

business loan, business credit card, business loans, business finance, business credit builder, business credit, business credit scores, build business credit, business financing, business funding

businessloan, businesscreditcard, businessloans, businessfinance, businesscreditbuilder, businesscredit, businesscreditscores, buildbusinesscredit, businessfinancing, businessfunding

Copyright © 2024 TMMinistry of Civil Affairs© PMA | All rights reserved.

This website is operated and maintained by TMMinistry of Civil Affairs© PMA A/K/A LNCF. Use of the website is governed by its Terms Of Use and Privacy Policy. TMMinistry of Civil Affairs© PMA A/K/A LNCF is a Lawfully formed Private Membership/Ministerial Association, that will assist in building strong local communities that are well grounded in love, family values, sharing, and respect for other people and what is God given lawful. We do not sell a “get rich quick” program, or money-making system. We believe, with education, individuals can be better prepared to make investment decisions, but we do not guarantee success. We do not make earnings claims, efforts claims, or claims that our businesses will make you any money. All material is intellectual property and protected by copyright. Any duplication, reproduction, or distribution is strictly prohibited. Investing of any kind carries risk and it is possible to lose some or all of your money. The business build out provided is general in nature, and some strategies may not be appropriate for all individuals or all situations. We make no representation regarding the likelihood or probability that any actual or hypothetical investment will achieve a particular outcome or perform in any predictable manner. Statements and depictions are the opinions, findings, or experiences of individuals who generally have purchased our business build out package in the past. Results vary, are not typical, and rely on individual effort, time, and skill after the business has been delivered to the member, as well as unknown conditions and other factors. We do not measure earnings or financial performance. Instead, we track completed transactions and satisfaction of services by voluntary surveys and or reviews. You should not, however, equate reported sales transactions with financially successful transactions. Further, many customers do not continue with the program, do not apply what they learn, or do attempt to apply what they learn but nonetheless have difficulty in business management even with our provided step by step simple success methods that have worked for many other business owners. The PMA may link to content or refer to content and/or services created by or provided by third parties that are not affiliated with the PMA. The PMA is not responsible for such content and does not endorse or approve it. The PMA may provide services by or refer you to third-party businesses. Some of these businesses have common interests and ownership with the PMA. This site is not a part of the YouTube, Bing, Google, or Facebook website; Google Inc., Microsoft INC, or Meta Inc. Additionally, This site is NOT endorsed by YouTube, Google, Bing, or Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc. YOUTUBE is a trademark of GOOGLE Inc. BING is a trademark of MICROSOFT Inc. TMMinistry of Civil Affairs© PMA A/K/A LNCF

Legal New Credit File

The legal team at TMMinistry of Civil Affairs© PMA A/K/A LNCF Stands as a beacon of hope for the traditional consumer. Comprising a dynamic association of members who operate as Attorneys-in-Fact for our PMA registered members, each brings a unique blend of expertise, passion, and dedication to the table.

With backgrounds in corporate law, civil rights, and criminal defense, they offer comprehensive legal services that cater to everyday people. Their mission is to provide legal clarity about consumer privacy while upholding the values of integrity, transparency, and client-focused service.

Since its inception, LNCF has made significant strides in the legal community, earning trust for their innovative approach to complex contract challenges in the privacy space.

The team’s collaborative spirit is the cornerstone of their success, allowing them to leverage their individual strengths in a unified strategy. Whether navigating high-stakes client transitions or offering in-depth consulting services, they remain committed to making a positive impact in the lives of their clients and the broader American community.

[…] BUSINESS CREDIT […]

[…] BUSINESS CREDIT […]

[…] BUSINESS CREDIT […]

[…] BUSINESS CREDIT […]

[…] BUSINESS CREDIT […]

[…] BUSINESS CREDIT […]