PURCHASES WITH YOUR CPN

Once your authorized user/s and primary accounts have posted to your CPN, you can then go shopping.

Personal Cell phones

T-Mobile is the quickest to approve finance for a cell phone, with a score of 600 or higher.

I’m not saying you won’t have to put money down, but your deposit will be significantly lower. For example, if an iPhone costs $1,099 and your CPN score is 605, you could pay $150 deposit, instead of $1,000 with a blank CPN.

This still leaves plenty of room for you to upsell the phone. The higher your credit score, the lower the deposit.

Buying Cell Phones for Business

People often ask, “How do I get 10 or more phones on my CPN?” You’ll need a business account to accomplish this.

It’s simple to set up but requires an EIN number. More detail about opening business accounts HERE.

To make purchases with a business account you’ll need to go to a T- Mobile store or call their customer service line and tell them you want to set up a business account.

This will allow you to buy multiple phones for your employees. In order to get phones, they usually give you around a $5,000 credit limit on a new account.

Don’t limit yourself to phones;

Consider Apple watches, other smartwatches, and other smart devices such as tablets, computers or iPads. These are all products that will sell quickly and easily if you don’t need them for business purposes.

Best Buy

Best Buy is one of the most overlooked hacks. First, when you buy in-store, you can sign up for the Best Buy credit card as well as lease-to-own options.

I have seen many people buy TVs with a score of just over 600 and put no money down. Even if you cannot get the BestBuy card and only can get approved for the lease-to-own option this is still a very good hack.

If you use this process, be aware that it will report to your CPN and it will reflect on your credit score.

If you do not intend to pay for it, your score will drop and you will lose all your work to build your CPN.

It’s also a great way to build your credit if you’re going to pay for it and keep the items yourself.

Affirm

Most of you have heard of Affirm. You’ve probably seen it when you’re about to check out on a website and it says you only have to pay a small amount today and a small amount monthly.

For example, you could get a new PlayStation for $499, but you’d only have to pay $29.95 today. This works well with CPNs that have primary accounts attached to them. It is very simple to obtain.

It’s a good way to build your CPN if you’re trying to use it legitimately. You must have a credit score of at least 640 to use it, but people have reported getting approved with as low as 600.

Furniture Stores

Value City Furniture, and American Freight, are some stores where you can get easy approval for credit with a CPN. You can furnish your Airbnb businesses with these companies using your CPN.

There are two options here: either pay it back monthly and build your credit, or have the furniture delivered to another address and move it to where you want it to be.

Store Credit

A few other places where you can use this method to obtain store credit or store cards. Walmart, Target, Kay Jeweler, Reeds Jewelry, Jared’s, Macy’s, any and all gas

station gas cards, Spectrum, AT&T, Sam’s Club, Wayfair, and many more are all available. So, use your CPN frequently when signing up for reward programs, store credit cards, and store credit, and you’ll be surprised at how many doors it opens.

Now, let’s talk about how to make some serious lifestyle changes where we’ll discuss how to get apartments and home rentals with your CPN within the first 2 to 3 weeks.

CHANGE YOUR STANDARD OF LIVING

YOU CANNOT BUY A HOUSE WITH A CPN NUMBER!

Now that I’ve cleared that up, we can get started on improving your standard of living. I know people who have moved with CPN’s from one city to another. Using a CPN, is one of the simplest ways to improve your living situation that will not take much time. When done correctly, this should take about two to three weeks.

When looking for an apartment, it’s critical to understand whom you’re working with. If it is an upscale environment, expect them to do more research on you than if it was created for minimum-wage workers.

I always call first to get a sense of the people I’m about to work with. I always inquire whether they have any two or three-bedroom apartments available and if so, when will they be ready for occupancy.

I then inform them that I do not have bad credit. I just don’t have a lot of it because I’ve spent most of my adult life living at home with my parents. I further explain that because of this, they’ll probably only see a few things on my credit.

By doing so, you will prepare them to understand why your credit score is not as lengthy or “light”. These people are paid a commission based on how many tenants they can get into the building, so believe me when I say they want you to be approved.

You should never enter the office without first being approved. Always submit your applications online so that if anything goes wrong, you can handle it instead of looking like a fool in front of management.

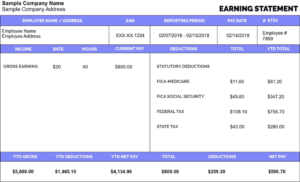

If you follow the instructions, your CPN should be in your name and have your date of birth, so you can apply with your state ID. If you are not working or are paid under the table, you may be required to create pay stubs.

The main thing they want to see is that you have at least three times the rent. You’ll want to make sure your real or fake pay stubs show that. If you’re making paystubs, always state that you make at least $75,000 per year. When you make at least $75,000 per year, almost no one will turn you down.

They will also look to see if you have any criminal history, such as felonies, drug charges, sexual abuse, and so on. CPN will cover your entire legal history; when it’s run, the only thing they’ll see is the information you’ve tri-merged together.

Most places will not ask for a copy of your Social Security card because they do not want that type of information on file that can easily be used for fraudulent purposes. Instead, they will ask to see your ID to ensure that your name and date of birth match the social security number that you have given them.

Every location is different, but you should receive your approval phone call within 24 to 48 hours. If they ask for job verification, always have a friend who can do it for you; they will simply ask, “Do you work there?” “How long have you been working there?” “What is the pay rate?” Some places will also check with previous landlords. Again, you can easily get around this by telling them you have lived with your parents for the majority of your adult life.

And there you have it, your new home. This method also works for renting a house; in fact, renting a house is easier than renting an apartment, especially if you go through the homeowner directly. They will not typically conduct a background check or job verification.

If you are not working or are paid under the table, you may be required to create pay stubs.

Pay Stubs

Do it yourself Pay Stubs that pass SNAPPT Apartment Complex verification and much more: https://paystubdepot.com/

But I know you’ll need more than just a place to live; you’ll need utilities, furniture, and whatever else the apartment lacks. In the previous chapter, I discussed how you can get furniture from ValueCity, American Freight, and even Wayfair. All of these establishments are CPN-friendly and do not require a lot of money to get anything.

You can also place your utilities in your CPN, cable, light, etc. Once you begin applying, this will all take about two days to complete.

How to START AN AIRBNB BUSINESS

You can have multiple apartments or homes on one CPN.

How to get your Airbnb’s in place, location, and everything else;

One of the most frequently asked questions we receive is, “How do you start an Airbnb business?”

The following will go over:

-To furnish your property: Use sites provided above

-Lights can be registered on your CPN.

-Spectrum Cable is CPN-friendly, and the water bill is more than likely included in your rent.

Here are some tips for running a successful Airbnb business.

Location

The most important factor is LOCATION, LOCATION, LOCATION. People will accept a smaller space as long as it is in a prime location. For example, you might want to a location near shopping, interstate, movie theaters, sports arenas, and so on.

I know people in Southern California who charge $1,500 per night for studio apartments simply because of their location. When choosing a location, make sure it is in a high-traffic area; these are the areas that people will want to rent out.

People are always looking for nice restaurants and shopping malls. Look for cities with a lot of attractions, such as Miami, Los Angeles, or New York. Anywhere with a high tourist population will do well.

I’m sure you’re wondering how you can get an apartment or a house if you don’t live in the city. It’s very simple, just like getting an apartment or a home in your city. Everything should be done online, and once you’ve secured the place, you can fly in to pick up the keys or drive if it’s close enough.

Do the furniture hack as discussed previously, and find out what the policy is for putting a lockbox somewhere near the location. The lockbox ensures that you do not need to be present to exchange the

keys. It can be placed outside the apartment or even at a remote location where you must enter a code to open a box to receive the key.

2 Night Minimum

I highly recommend at least a two-night minimum on all properties. If you’re charging at least $250 you know that in a week’s time at a minimum you will make $500 a week. This means you will be making

$2,000 a month off of that one unit. Staying booked isn’t difficult; you can advertise your home on Craigslist, Facebook Marketplace, and even local newspapers.

SIZE

You don’t have to begin with a three- or four-bedroom home. Again, studio and one-bedroom apartments are doing well in major cities. Of course, the larger the house or apartment, the higher the rate. I know people who have converted abandoned warehouses into lofts. Putting five or six beds in an open area, possibly with a bar and some cool furniture, can go a long way.

Subleasing

Most places require a lease if someone stays for more than 14 days, so only rent out your Airbnb for 13 days at a time. If it says 30 days, only rent it out for 29 days at a time, and always rent it out a day early so you never have to legally put a guest on a lease.

No Parties Allowed

No parties are permitted at your Airbnb. When renting out to others, make sure to include this in the details of your listing on Airbnb. If you place a Ring Doorbell on your location, the security system will

allow you to watch the people as they enter; if it looks like a party is about to start, give your attendees a call and shut it down right away. You also have the option of accepting or declining people

who try to rent out your Airbnb through the app. You don’t have to accept every offer made to use your space. If they appear to be young college students, you can decline the offer because all money is not good money.

Fee

Check out the competition on the Airbnb app. Log in as a guest looking to rent a similar property to yours in the same location. It will show you what other properties in the area have been listed for in the last 30 days. You should always upsell yours by at least $25.00. You may be wondering, “Why would I increase my prices in comparison to my competition?”. You always want to list your Airbnb as a luxury

accommodation. People want to feel like they are in a luxurious environment, so they are willing to pay a premium for it. If a similar property is being rented for $200 a night, you should be renting yours for at least $225.

Multiple Airbnbs

Yes, you can run multiple AirBnBs from a single CPN. Nobody cares how many houses you own as long as you have the money to maintain them. No one is going to deny you if your pay stubs show

that you make more than enough money to take care of your home. Just make sure that your previous Airbnb paid for your new one. That is always the rule of thumb; you should not be paying anything out of pocket because your rental property should cover itself and another one each time.

ADMIN