Advanced credit repair service

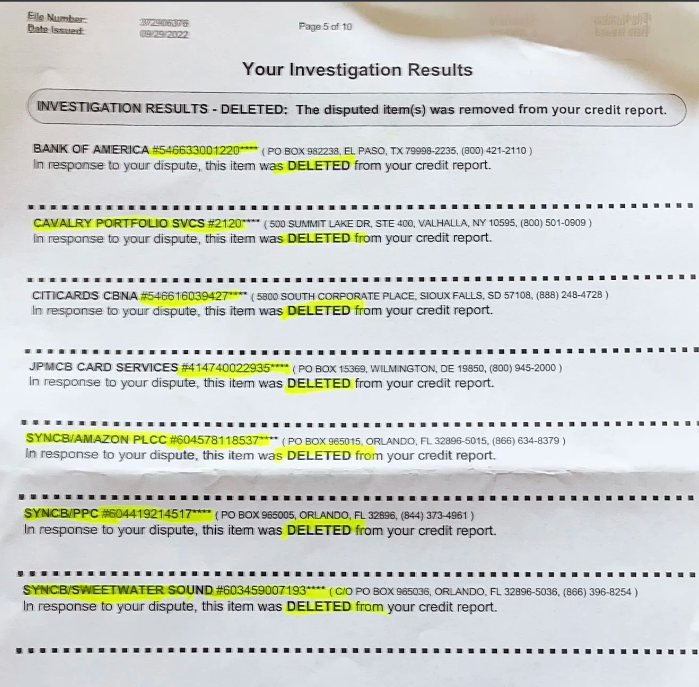

Unlike other firms that rely on inexpensive software for generic email templates 📧 and limit their disputes to credit bureaus or regulatory bodies like the CFPB and FTC, 🏛 we engage in direct disputes with the actual companies listed on your credit report. 📊

By addressing and removing accounts directly at the source of the debt, 💼 we ensure that the credit bureaus have nothing to report in their next cycle, 🔄 as the account has been eliminated from the record.

- You can finally get approved for some credit cards. Many secured credit cards and some regular credit cards will approve people with 580+ scores. This is a huge step up from being rejected everywhere.

- You can get approved for auto loans from many lenders. Car dealerships and credit unions often work with people who have 580+ scores. You'll have transportation options you didn't have before.

- Some apartment complexes will now rent to you. While pickier landlords still might say no, many property managers will accept tenants with scores around 580.

- You can get personal loans from some online lenders. Companies like OneMain Financial, Avant, and credit unions often approve people with your score range.

- You're eligible for FHA home loans in some cases. While you'll need a larger down payment (10% instead of 3.5%), homeownership is actually possible now.

- Utility companies are more likely to skip security deposits. Electric, gas, and internet companies often waive deposits for customers with 580+ scores.

- You've proven you can turn your credit around. Getting to 580 from a very low score shows you've been making consistent improvements and paying bills on time.

- You're now just 20-40 points away from "good" credit territory. Once you hit 620-640, you'll see a huge jump in your options and much better interest rates.

- Banks see you as someone who's working to improve. The upward trend in your score matters just as much as the current number.

At LNCF, we are dedicated to empowering you to take control of your financial future.

We believe that everyone deserves the chance to turn their dreams into reality, whether it’s buying a house, a car, or anything else you desire.

Our commitment goes beyond mere credit repair; we are a comprehensive solution.

Our team consists of industry-leading experts and program developers who are passionate about helping you not just clear your credit but also acquire the skills needed to maintain an improved credit score for the long term.

With LNCF by your side, your financial goals are not just dreams; they are within reach, ready to become your reality.

Because many credit issuers / underwritters / businesses are unable to produce an authentic bill or legally confirm a debt, we encourage account managers to eliminate accounts to avoid legal proceedings.

When a business recognizes the likelihood of having to formally appear in court, it often leads to greater consideration for the account holder and usually results in the removal of the account.

STANDARD CREDIT REPAIR SERVICE

$1,495.00

- 💳Start with half down: $747.00

- 💵Money Back Guarantee if No Results in 180 Days

- 💼⚙️Credit Repair with Advanced Techniques (Direct Disputing)

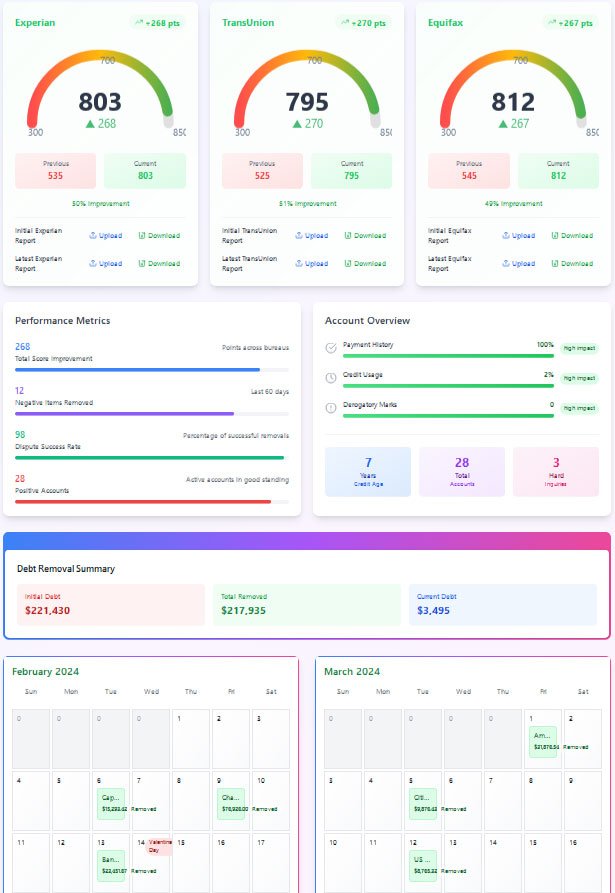

- 📊🖥️ Access to a Credit Repair Dashboard to see updates as they happen

- ⚖️Attorney approved (non-template letters)

- 3️⃣Three Major Credit Bureaus CFPB complaint filing

- 📬Up-to $600 in Certified Mail is sent on your behalf

- 🕰️ 60-90 Day Delivery for Bulk of Deletions

- 📑Minimal Paperwork for you

- ⚒️This is Manual Credit Repair (no software!)

- 🚀1 Credit Certified Specialist working with attorney on your file

- 📝Filing for negotiations of debt upon none removals

👮♂️FTC (Federal Trade Commission) Report, Personal Information Freeze or Blocking (Advanced Resolution Service., CoreLogic, Lexis Nexis, Sage Stream, Chexsystem, Innovis).

Whats removed:

- Collections

- Chargeoffs

- Foreclosures

- Medical Collections

- Late Pay

- Repossession

- Student loans

- Bankruptcy

- Inquiries / Hard Inquiry Removing (all)

- Manual Credit Repair Direct Disputing

Consider the Savings: Would you rather invest a $1,495 service fee or keep shouldering debts ranging from $10,000 to $1,000,000? The choice speaks for itself.

EXPRESS CREDIT REPAIR SERVICE

⏳ALL ACCOUNTS TAKEN CARE OF WITHIN 60 DAYS!!! 🎉

$1,995.00

- 💳 Half Down To Get Started

- ✅✨ Everything included in the standard package above, plus:

- 💳💪 1 X Rental Primary (see here) 5-8 Years Rental History – Permanent Tradeline that stays on your credit forever (SSN or CPN)

- ⏳💼 ALL ACCOUNTS TAKEN CARE OF WITHIN 60 DAYS!!! 🎉

- 💼⚙️Credit Repair with Advanced Techniques (Direct Disputing)

- 📊🖥️ Access to a Credit Repair Dashboard to see updates as they happen

- 💵Money Back Guarantee if No Results in 30 Days

- Exclusive dispute templates and credit optimization strategies unavailable anywhere else – proven methods to clean up your credit profile for both personal and business accounts that can be used for years to come after you experience them working yourself through our service.

- You also get access to An amazing method to be able to post your own primary trade lines on any SSN or CPN account for you and your family network as well any business you fully want to manage the credit score profile of

- Takes control away from traditional credit scoring

- Uses your own money as leverage (not debt)

- Manual underwriting means human decision-making, not algorithm rejection

- Creates multiple positive trade lines from one strategic move

- Works for both personal and business credit building

- Independence and not relying on 3rd parties is true freedom. The cost of freedom is knowledge!

Yes, I am ready to get started with credit repair service

read the credit repair service agreement below. When you’re ready submit it.

$600,000 IN DEBT REMOVED! WATCH THIS VIDEO!

“I really appreciate what you guys have done for me.

I have tried a number of credit repair bussinesses ,

but none worked and I’m very happy that I run into

LNCF. Thank You for everything

Thank You“

LNCF Response:

We are very happy you are pleased with our service Tom!

Tom W.

March 4th 2024

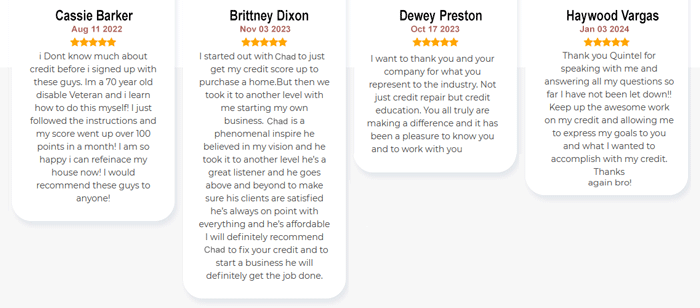

Success Stories

See how our credit repair service has helped people just like you achieve financial freedom

Darnell Washington

Atlanta, GA

March 2023

After losing my job during the pandemic, my credit score dropped to 520. I couldn't qualify for an apartment or car loan. Within 3 months of working with this service, my score jumped 115 points! They removed four collections that were past the statute of limitations. I just got approved for a new car with a reasonable interest rate.

Keisha Johnson

Chicago, IL

January 2024

I was denied for a mortgage because of old medical debt collections and a tax lien. This service helped me dispute and remove $23,000 in medical collections that were incorrectly reported. My score improved by 143 points in 4 months, and I just closed on my first home last week! Their team was with me every step of the way.

Jamal Brooks

Houston, TX

April 2025

I was a victim of identity theft that left me with a 540 credit score. This service helped me file the proper reports and dispute all the fraudulent accounts. My score improved by 127 points in just 10 weeks. They helped me identify and remove fraudulent accounts I didn't even know about. I finally qualified for a business loan to expand my barbershop!

Melissa Kumar

Austin, TX

February 2020

After my divorce, my credit score plummeted to 540. I couldn't qualify for an apartment in a safe neighborhood for my kids. Within 4 months of working with this service, my score jumped 129 points! They removed three collections that weren't even mine. I just got approved for my dream apartment.

Jessica Wang

Los Angeles, CA

January 2022

I was denied for every credit card I applied for because of old medical debt collections. This service helped me dispute and remove $15,000 in medical collections that were past the statute of limitations. My score improved by 139 points in 90 days, and I finally got approved for my first rewards credit card!

Marcus Wilson

Portland, OR

September 2020

I was drowning in debt with a credit score of 569. After 2 months, my score increased by 123 points! The tax lien that was incorrectly reported was removed within weeks. Their dashboard made it easy to track everything in one place. I finally qualified for a car loan with a decent interest rate.

Elizabeth Chen

Indianapolis, IN

November 2022

I had a bankruptcy from 5 years ago that was preventing me from getting a mortgage. This service helped me rebuild my credit with proper guidance on secured cards and credit builder loans. My score improved by 147 points in 5 months. I just closed on my first home last week!

Noor Campbell

Detroit, MI

October 2022

I had seven late payments on my student loans that were killing my credit score. They helped me write goodwill letters to my loan servicer, and 5 of the 7 late payments were removed! My score went up 61 points in just 60 days. The dashboard is so useful - I can see all my progress in one place.

Yan Huang

Oklahoma City, OK

March 2025

I was denied an auto loan because of identity theft that tanked my credit. This service helped me place fraud alerts, file police reports, and dispute all the fraudulent accounts. My score went up 71 points in 60 days. I just got approved for a car loan with a 3.9% interest rate!

Sofia Shah

San Antonio, TX

January 2020

I had a 620 credit score and couldn't get approved for a conventional mortgage. After working with this service for 3 months, they helped me remove outdated collections and a repossession that should have fallen off years ago. My score improved by 99 points, and I qualified for a conventional loan with a great rate!

Hassan Hall

Indianapolis, IN

January 2024

I was drowning in debt with a credit score of 535. After 5 months, my score increased by 74 points! They helped me create a debt payoff strategy that actually worked. I was able to refinance my mortgage and save $350 each month. What I love most is the all-in-one dashboard that shows everything I need.

Karen Li

Fresno, CA

July 2024

I had a credit score of 583 with multiple collection accounts. After 2 months, my score increased by 87 points! They helped me establish a positive payment history and negotiated pay-for-delete agreements with my creditors. I finally got approved for a car loan after being denied multiple times.

Jamal Brooks

Houston, TX

April 2025

I was a victim of identity theft that left me with a 540 credit score. This service helped me file the proper reports and dispute all the fraudulent accounts. My score improved by 127 points in just 10 weeks. They helped me identify and remove fraudulent accounts I didn't even know about. I finally qualified for a business loan to expand my barbershop!

Tasha Williams

Philadelphia, PA

February 2024

My credit score was stuck at 580 for years. I tried everything to improve it but nothing worked. This service found errors on my report that I didn't even know existed. They disputed them all and got them removed in just 45 days. My score jumped 95 points, and I was finally able to get approved for a credit card with rewards!

Michael Rodriguez

Phoenix, AZ

March 2023

I had a credit score of 610 and was denied for a small business loan. This service helped me create a strategic plan to improve my score. They identified negative items that could be disputed and helped me establish positive credit history. In just 3 months, my score increased by 85 points, and I got approved for the loan I needed!

Sarah Thompson

Nashville, TN

January 2025

After a medical emergency, my credit score dropped to 550 due to unpaid bills. This service helped me negotiate with the hospital and get the medical collections removed. They also helped me dispute errors on my report. My score increased by 112 points in just 60 days. I'm now able to qualify for a mortgage with a great interest rate!

David Chen

Seattle, WA

October 2022

I had a credit score of 590 and couldn't get approved for an apartment in a good neighborhood. This service helped me identify and dispute inaccurate late payments on my student loans. They also helped me create a plan to pay down my credit card debt. My score improved by 78 points in 90 days, and I got approved for my dream apartment!

Noor Campbell

Detroit, MI

October 2022

I had seven late payments on my student loans that were killing my credit score. They helped me write goodwill letters to my loan servicer, and 5 of the 7 late payments were removed! My score went up 61 points in just 60 days. The dashboard is so useful - I can see all my progress in one place.

Jessica Wang

Los Angeles, CA

January 2022

I was denied for every credit card I applied for because of old medical debt collections. This service helped me dispute and remove $15,000 in medical collections that were past the statute of limitations. My score improved by 139 points in 90 days, and I finally got approved for my first rewards credit card!

Andre Jackson

Baltimore, MD

March 2024

I had $27,000 in collections from an old business debt that wasn't even mine. This service helped me prove that I was not responsible for the debt and got it completely removed from my credit report. My score jumped 156 points in just 75 days. I was able to refinance my home and save $450 per month!

Susan Lee

Denver, CO

May 2020

I had a judgment on my credit report that wasn't mine. This service helped me prove it was a case of mistaken identity and got it removed completely. After 3 months, my credit score improved by 83 points. I was able to refinance my mortgage and save hundreds each month.

Maria Gonzalez

San Diego, CA

February 2025

I had $32,000 in medical debt from a surgery that my insurance should have covered. This service helped me work with the hospital and my insurance company to get the bills properly processed. All the collections were removed from my credit report, and my score increased by 118 points in just 8 weeks!

Robert Kim

Minneapolis, MN

November 2023

I had multiple collections from an old apartment that I had actually paid off. This service helped me gather the proof of payment and dispute the collections. All of them were removed within 60 days, and my score increased by 92 points. I was finally able to get approved for a car loan with a decent interest rate!

Keisha Johnson

Chicago, IL

January 2024

I was denied for a mortgage because of old medical debt collections and a tax lien. This service helped me dispute and remove $23,000 in medical collections that were incorrectly reported. My score improved by 143 points in 4 months, and I just closed on my first home last week! Their team was with me every step of the way.

Melissa Kumar

Austin, TX

February 2020

After my divorce, my credit score plummeted to 540. I couldn't qualify for an apartment in a safe neighborhood for my kids. Within 4 months of working with this service, my score jumped 129 points! They removed three collections that weren't even mine. I just got approved for my dream apartment.

Tariq Miller

Washington, DC

February 2025

After my divorce, negative items from joint accounts destroyed my credit. This service helped me separate my credit from my ex-spouse's and dispute inaccurate information. My score improved by 81 points in 8 weeks. The negative items from my divorce were all removed successfully. I just got approved for my own apartment!

Elizabeth Chen

Indianapolis, IN

November 2022

I had a bankruptcy from 5 years ago that was preventing me from getting a mortgage. This service helped me rebuild my credit with proper guidance on secured cards and credit builder loans. My score improved by 147 points in 5 months. I just closed on my first home last week!

Jose Rivera

Milwaukee, WI

December 2021

I was denied for an apartment three times because of my poor credit history. This service helped me dispute old collections and late payments. After 90 days, my score increased by 44 points! I finally got approved for an apartment in my preferred neighborhood. The dashboard made it easy to track my progress.

Sofia Shah

San Antonio, TX

January 2020

I had a 620 credit score and couldn't get approved for a conventional mortgage. After working with this service for 3 months, they helped me remove outdated collections and a repossession that should have fallen off years ago. My score improved by 99 points, and I qualified for a conventional loan with a great rate!

Hassan Hall

Indianapolis, IN

January 2024

I was drowning in debt with a credit score of 535. After 5 months, my score increased by 74 points! They helped me create a debt payoff strategy that actually worked. I was able to refinance my mortgage and save $350 each month. What I love most is the all-in-one dashboard that shows everything I need.

Darnell Washington

Atlanta, GA

March 2023

After losing my job during the pandemic, my credit score dropped to 520. I couldn't qualify for an apartment or car loan. Within 3 months of working with this service, my score jumped 115 points! They removed four collections that were past the statute of limitations. I just got approved for a new car with a reasonable interest rate.

Marcus Wilson

Portland, OR

September 2020

I was drowning in debt with a credit score of 569. After 2 months, my score increased by 123 points! The tax lien that was incorrectly reported was removed within weeks. Their dashboard made it easy to track everything in one place. I finally qualified for a car loan with a decent interest rate.

Yan Huang

Oklahoma City, OK

March 2025

I was denied an auto loan because of identity theft that tanked my credit. This service helped me place fraud alerts, file police reports, and dispute all the fraudulent accounts. My score went up 71 points in 60 days. I just got approved for a car loan with a 3.9% interest rate!

Karen Li

Fresno, CA

July 2024

I had a credit score of 583 with multiple collection accounts. After 2 months, my score increased by 87 points! They helped me establish a positive payment history and negotiated pay-for-delete agreements with my creditors. I finally got approved for a car loan after being denied multiple times.

Richard Carter

Cincinnati, OH

February 2021

After my business failed during the pandemic, my credit score dropped to 590. This service helped me dispute inaccurate late payments and create a debt management plan. After 2 months, my credit score improved by 101 points. I got approved for a car loan with a much lower interest rate than I expected.

Aisha Sanchez

Columbus, OH

April 2025

I was a victim of identity theft that left me with a 530 credit score. This service helped me file the proper reports and dispute all the fraudulent accounts. My score improved by 117 points in 12 weeks. They helped me identify and remove fraudulent accounts I didn't even know about. I can finally qualify for an auto loan!

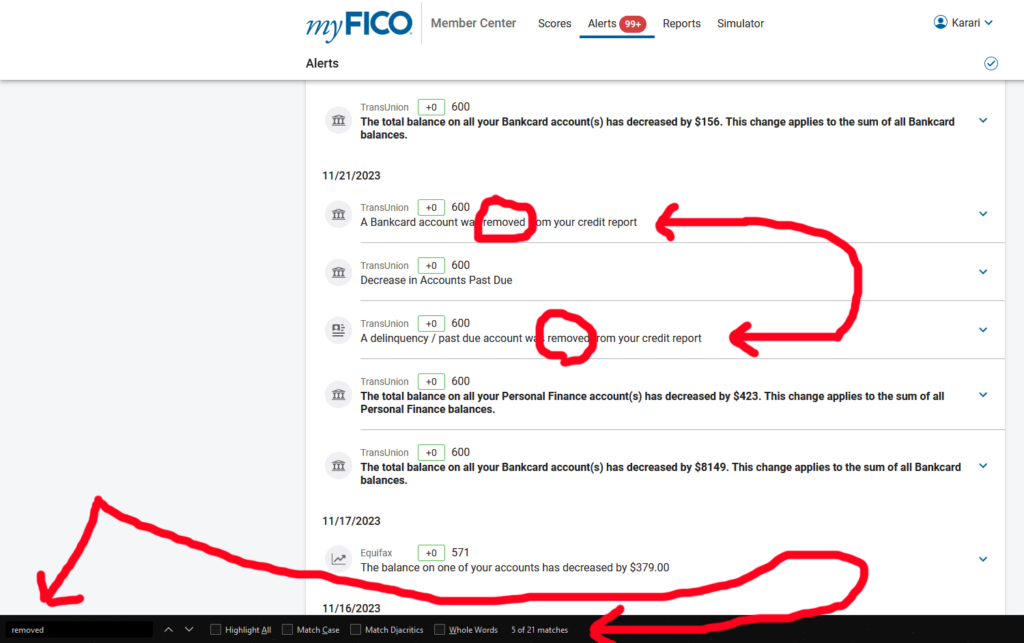

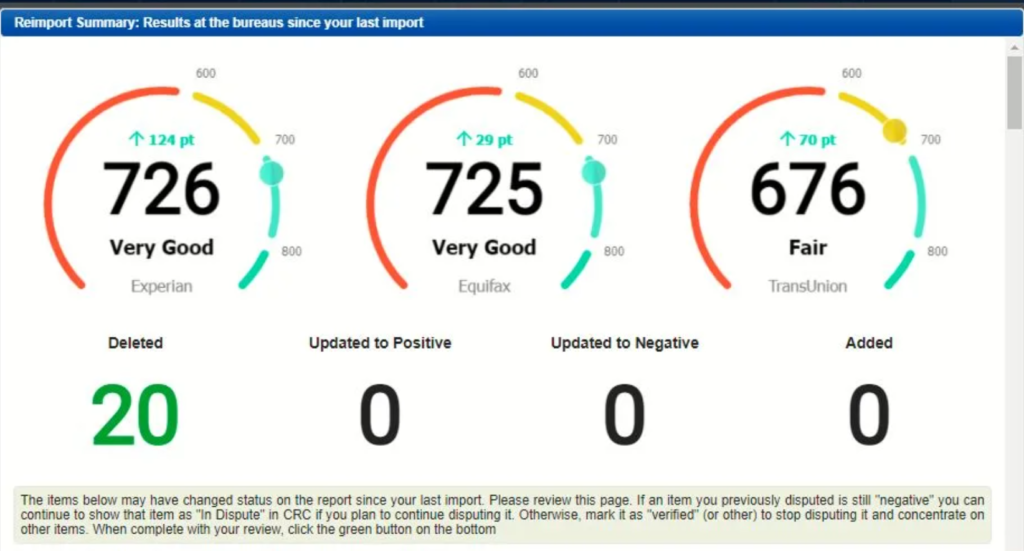

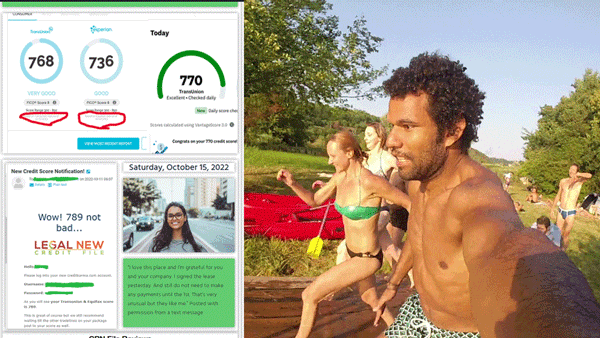

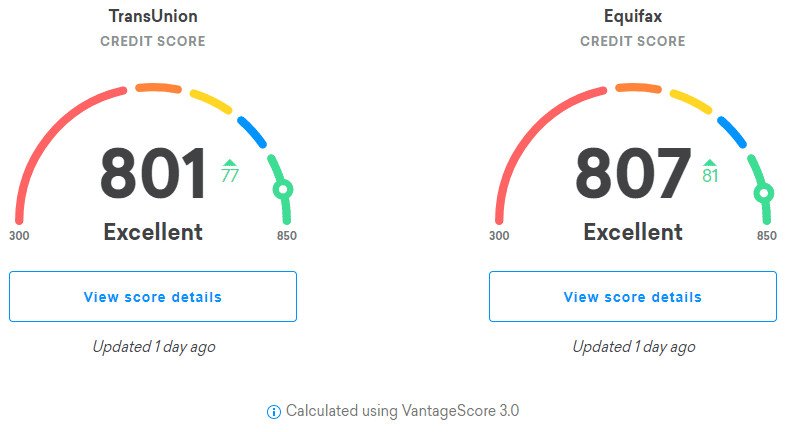

Our Credit Repair Service delivers exceptional results (see proof below).

Facing the challenges of a poor credit history can be daunting, affecting your ability to secure loans, credit cards, and even rental approvals.

However, imagine a credit repair service that not only boosts your credit score but does so without straining your finances – that’s where our “Credit Repair Service” comes in.

Our service is committed to providing top-tier credit repair assistance at a reasonable cost, acknowledging that not everyone can invest significantly in credit repair.

Our focus is to furnish outstanding service while keeping expenses minimal.

Wondering what our “Credit Repair Service” brings to the table?

To begin with, we collaborate with you to scrutinize your credit report, identifying and rectifying errors that may be impacting your score.

Additionally, we devise a personalized credit repair plan aligned with your unique needs and objectives.

It’s not solely about rectifying mistakes; our “Credit Repair Service” also provides guidance on boosting your credit score with guides and frequent consultations.

One standout feature of our “Credit Repair Service” is our transparency in pricing.

No hidden fees or unrealistic promises; we present straightforward and affordable pricing that is easy to comprehend.

If you find yourself grappling with poor credit and seek assistance in elevating your score, we highly recommend exploring our “Credit Repair Service.”

We are the genuine article, delivering exceptional service at an unmatched price point.

Don’t let bad credit hinder your progress any longer – seize the opportunity today to have the credit score you deserve with the support of the best “Credit Repair Service.”

*PLEASE NOTE: Starting service with us indicates your acknowledgment and agreement to our Credit Repair Terms.

LNCF

From Credit Crisis to Financial Freedom: The Life-Changing Power of Credit Repair

Table of Contents

ToggleIn today’s world, a good credit score is more important than ever before. For most people, credit is necessary to access essential needs like housing, transportation, and even employment.

However, far too many find themselves struggling with poor credit and credit challenges that significantly limit their potential for financial success and upward mobility.

Poor credit closes doors and prevents access to the resources needed to achieve dreams like home-ownership, running a business, or pursuing higher education.

The higher costs and lack of access that come with bad credit make it incredibly difficult to break the cycle of financial hardship.

With so much riding on credit scores, those with credit challenges often feel overwhelmed and powerless to create positive change.

Damaged credit contributes to a sense of permanent financial stagnation.

However, our credit repair services represent a powerful resource to help individuals restore their creditworthiness and reclaim their financial futures.

When paired with financial education and responsible habits going forward, our credit repair service lays the groundwork for long-term credit health and financial freedom.

By addressing errors and inaccuracies on your credit reports, our credit repair provides a second chance to under-served populations so they can access the credit they need to unlock new opportunities.

With professional guidance on credit repair strategies, anyone can transform their financial standing and gain access to a brighter future.

Credit Score Basics

A credit score is a numerical representation of your creditworthiness, summarized from details in your credit report. Credit scores are calculated using a credit scoring model, with FICO and VantageScore being the most widely used models.

FICO credit scores range from 300 to 850. In general, a FICO score above 700 is considered good, 670-699 is fair, 580-669 is poor, and under 579 is very poor. The factors that influence your FICO credit score include:

- Payment history (35% of score): Whether you pay your bills on time. Late payments can negatively impact your score.

- Credit utilization (30%): The ratio between your total balances and total credit limits. Using too much of your available credit can lower your score.

- Length of credit history (15%): How long you’ve had credit accounts open. Having a longer credit history tends to improve your score.

- New credit (10%): Opening many new accounts in a short period can negatively affect your score.

- Credit mix (10%): Having different types of credit accounts (credit cards, loans, mortgages, etc.) can help your score.

VantageScore credit scores also range from 300 to 850. The factors that influence your VantageScore include:

- Payment history

- Age and type of credit

- Percentage of credit limit used

- Total balances and debt

- Available credit

- Recent credit applications

- Credit mix

While the models differ slightly, both FICO and VantageScore aim to provide a snapshot of creditworthiness. Monitoring your scores and the factors that affect them is key to maintaining and improving your credit standing.

Impacts of a Low Credit Score

A low credit score can have profound impacts on a person’s financial health and opportunities. Here are some of the key areas that are affected:

Access to Loans and Higher Interest Rates

- Individuals with credit scores below 620 pay an average of $3,238 more per year in mortgage payments compared to those with excellent credit (scores above 760). [1]

- Car insurance rates can be up to 267% higher for those with poor credit compared to those with excellent credit. [2]

- 92% of mortgage lenders require a minimum credit score of 620 to qualify for a home loan. [3]

- Credit cards for people with low credit scores often have interest rates exceeding 25% compared to around 15% for those with excellent credit. [4]

Higher Insurance Premiums

- Drivers with poor credit pay 95% more on average for car insurance than drivers with excellent credit. [5]

- Homeowners insurance rates can be up to 124% higher for those with very poor credit compared to those with excellent credit. [6]

- Average annual savings in auto insurance premiums between drivers with poor and excellent credit exceeds $1000 in most states. [7]

Limited Rental Housing Options

- 58% of renters were denied leases because of poor credit history, according to a TransUnion survey. [8]

- Landlords often require credit scores of 650 or higher to approve rental applications. [9]

- Renters with low credit are more likely to be limited to less desirable properties in terms of location and amenities.

Reduced Job Prospects

- 47% of employers conduct credit background checks on some or all job candidates as part of hiring screening. [10]

- Job applicants with low credit scores are 50% less likely to receive job offers compared to those with excellent scores. [11]

- Poor credit history conveys irresponsibility and financial risk to employers.

A low credit score clearly has major detrimental impacts on access to affordable credit and insurance, quality housing, and employment prospects. Taking steps to improve credit should be a top priority.

How Credit Errors Occur

Credit report errors can happen for a variety of reasons. According to a report by the Consumer Financial Protection Bureau, around 1 in 5 consumers have verified errors in their credit reports that could affect their credit scores. Here are some common ways these errors happen:

Identity Theft

Identity theft is one of the leading causes of credit report errors. When someone steals your personal information and opens new credit accounts in your name, those accounts can show up on your report as delinquent. According to the Federal Trade Commission, around 14.4 million Americans were victims of identity theft in 2018.

Reporting Mistakes

Creditors and lenders submit information about your accounts to the credit bureaus. Sometimes they make mistakes, reporting incorrect balances, credit limits, or status updates. One study found that 79% of credit reports contained errors like these.

Unauthorized Accounts

In some cases, accounts that you never opened can appear on your credit report. This happens when creditors open accounts in your name without your approval. The 2017 Wells Fargo scandal revealed thousands of unauthorized accounts.

Mixed or Merged Files

The credit bureaus match credit information to specific individuals using names, addresses, and social security numbers. If two people have similar identifying information, their reports can become intermixed.

Outdated Information

Negative items are supposed to drop off your credit report after 7 years under the Fair Credit Reporting Act. But credit bureaus sometimes fail to remove old or obsolete information. Studies show that 1 in 4 credit reports contained outdated items.

Regularly reviewing your credit reports and quickly disputing any errors is key. With vigilance, you can minimize the impacts of mistaken, unauthorized, or fraudulent entries on your credit standing.

Credit Repair Process

Our credit repair process involves several important steps to improve your credit score. Here is an overview of what you can expect when working with our credit repair service:

Step 1: Credit Report Review

The first step is to obtain copies of your credit reports from the three major credit bureaus – Equifax, Experian and TransUnion. We recommend IdentityIQ.com. We will thoroughly review your reports to identify any inaccuracies, errors or issues that may be negatively impacting your score. This review helps us create a customized credit repair strategy for you.

Step 2: Credit Disputes

Once we have identified potential errors or discrepancies, we will dispute these with the credit bureaus on your behalf. This may involve drafting dispute letters with evidence to have negative items removed or changed. We handle all correspondence and follow-up. Our experience with the dispute process helps us achieve results.

Step 3: Goodwill Interventions

For legitimate negative items that cannot be disputed, we will negotiate with your creditors, “direct disputing” and cite case law requiring them to remove the account or face fines etc. to have the items removed or changed. This involves non template specifically drafted legal letters that aggressively challenge their ability to provide certain proofs to validate the claim on the account/s in question.

Step 4: Ongoing Score Monitoring

Throughout the credit repair process, we regularly monitor your credit reports and scores with the major bureaus. This allows us to gauge progress and modify our strategy as needed. We won’t stop until we have optimized your score.

Estimated Timeline

Most clients begin to see real improvements in their credit reports and scores within 45-60 days. However, the process can take 3-6 months for more substantial results, depending on your specific credit situation. The key is patience and persistence. Rest assured we will continue disputing and negotiating on your behalf until your credit profile reflects your financial responsibility.

With our professional guidance, you can take control of your financial destiny. Contact us today to start your credit repair journey!

Hiring a Credit Repair Company

While you can attempt to repair your credit on your own, hiring a professional credit repair company like us can provide significant benefits. With our expertise and resources, we can help develop an effective strategy, provide time savings, and design tailored solutions to improve your credit faster.

Expertise

We are a quality credit repair company and have extensive knowledge of consumer credit laws and experience dealing with credit bureaus and creditors. We understand the intricacies of credit scoring and know how to efficiently correct reporting errors that negatively impact your score. Our expertise allows us to quickly identify issues on your reports and determine the optimal solutions.

Effort and Time Savings

Repairing errors on your credit reports can be an exhausting and time-consuming process. Our credit repair service has the capacity to handle the workload for you, communicating with the credit bureaus and filing disputes in a timely manner. This saves you the hassle and hours it would take to manage the process yourself. You can focus on other important areas of your life while our credit repair service works diligently on your behalf.

Customized Strategies

Every person’s credit situation is unique. A one-size-fits-all approach rarely brings optimal results. Quality credit repair services like ours develop tailored plans to address your specific credit problems and goals. This personalized strategy improves your chances of seeing meaningful score increases quickly.

We will explain your legal rights, Our service is outlined clearly above, and we let you track progress. We are a reputable company that will truly help improve your credit. With a trustworthy partner guiding your credit repair, financial freedom is actually within reach.

After Credit Repair

Once your credit score has been restored through the credit repair process, it’s crucial to adopt habits that will maintain your improved creditworthiness over the long-term. Here are some tips for responsible credit management going forward:

- Keep balances low: Carrying high balances close to your credit limits negatively impacts your credit utilization ratio. Keeping balances under 30% of your total credit limit is ideal.

- Make payments on time:Payment history is the biggest factor affecting your score. Set up automated payments or calendar reminders to avoid missed payments.

- Limit credit inquiries:Each application for new credit results in a hard inquiry, which can lower your score. Only apply for credit when absolutely necessary.

- Monitor your credit report:Review your credit report regularly and dispute any errors right away to prevent inaccurate information from affecting your score.

- Practice healthy credit habits:Such as not closing old accounts, keeping old cards active, and limiting how often you open new credit. This will help demonstrate longevity and stability.

- Avoid cosigning loans:Taking on debt obligations that aren’t yours can backfire and damage your credit if payments are missed. Say no to cosigning.

With diligence and healthy credit habits, the benefits of an excellent credit score can be maintained long-term. Our credit repair service empowers you with the knowledge and tools to continue building your financial future.

About Our Credit Repair Service

Our credit repair service has been helping consumers improve their credit for many years. We understand the hurdles people face when rebuilding their credit, which is why our company is dedicated to guiding clients every step of the way.

With expertise across credit reporting regulations, credit scoring models, and direct creditor negotiation, our credit consultants can efficiently detect errors, develop corrective plans, and advocate for credit justice. We take pride in helping people move forward financially by establishing healthy credit.

What sets us apart is our commitment to personalized service. We match each client with a credit consultant who understands their unique situation and goals. Together, they create customized game plans to address credit report inaccuracies and optimize credit profiles. Our one-on-one approach delivers proven results.

In fact, our average client sees a credit score improvement within 45 days of working with us. We have a high% success rate disputing and deleting inaccurate information. And in 2-3 months our customers have seen incorrect late payments a full accounts eliminated from their credit reports worth 100K plus.

At LNCF, we empower people to take control of their financial lives. Our greatest reward comes from seeing clients qualify for car loans, home mortgages, competitive interest rates, and other opportunities that strong credit unlocks. We look forward to helping you rewrite your financial future. Contact us to schedule your free consultation and credit score analysis.

Contact Us

At LNCF, we are committed to helping you rebuild your credit and take control of your financial future. Our team of certified credit consultants have years of experience navigating complex credit reporting systems and negotiating with creditors and bureaus on your behalf.

To get started on your path to improved credit, contact us today for a free initial consultation. This no-obligation review will provide you with expert insights into your current credit situation and a personalized plan mapping out the next steps.

Get in Touch

- Phone: 800-597-2560

- Email: support@legalnewcreditfile.com

- Address: Our office hours are Monday to Friday, 9AM – 5PM PST

Book a Free Consultation

To request your free credit evaluation and repair quote, visit our website, email or call. One of our credit experts will be in touch shortly to review your credit report, identify opportunities, and provide a detailed analysis including estimated time-frames and costs.

With our customized strategies and hands-on guidance, you can improve your credit score, qualify for better rates and terms, and unlock greater financial freedom. Reach out today to start your credit repair journey.

Conclusion

In summary, maintaining a healthy credit score is essential for accessing loans, securing favorable interest rates, obtaining ideal rental housing, and boosting employment prospects.

However, errors in credit reports are surprisingly common, negatively impacting many individuals’ credit scores. Our credit repair service offers the knowledge and experience to identify and dispute credit report errors on your behalf. We work directly with the credit bureaus and your creditors to remove inaccurate information from your reports.

The credit repair process can take time, but by hiring our company, you gain the benefits of our credit expertise, tailored dispute strategies, and full attention to rectifying your credit challenges. We strive to help our clients restore their creditworthiness, empowering them to gain financial freedom and work towards their monetary goals.

Don’t let credit report errors jeopardize your financial future. Contact us today to get started with a free consultation. Our dedicated credit repair specialists will evaluate your credit reports, give expert advice, and take action to dispute inaccuracies for you. Now is the time to take control and get on the path towards improved credit.

[Source Links]- Source 1: https://www.cnbc.com/select/why-credit-repair-or-improvement/

- Source 2: https://www.foxnews.com/personal-finance/bad-credit-tanking-life-take-these-3-steps-to-repair-it

- Source 3: https://www.nerdwallet.com/article/finance/how-credit-repair-works

Legal New Credit File

The legal team at TMMinistry of Civil Affairs© PMA A/K/A LNCF Stands as a beacon of hope for the traditional consumer. Comprising a dynamic association of members who operate as Attorneys-in-Fact for our PMA registered members, each brings a unique blend of expertise, passion, and dedication to the table.

With backgrounds in corporate law, civil rights, and criminal defense, they offer comprehensive legal services that cater to everyday people. Their mission is to provide legal clarity about consumer privacy while upholding the values of integrity, transparency, and client-focused service.

Since its inception, LNCF has made significant strides in the legal community, earning trust for their innovative approach to complex contract challenges in the privacy space.

The team’s collaborative spirit is the cornerstone of their success, allowing them to leverage their individual strengths in a unified strategy. Whether navigating high-stakes client transitions or offering in-depth consulting services, they remain committed to making a positive impact in the lives of their clients and the broader American community.

Related Posts

9 Comments

Comments are closed.

[…] CREDIT REPAIR […]

[…] CREDIT REPAIR […]

[…] CREDIT REPAIR […]

[…] CREDIT REPAIR […]

[…] CREDIT REPAIR […]

[…] CREDIT REPAIR […]

[…] CREDIT REPAIR […]

[…] CREDIT REPAIR […]

[…] CREDIT REPAIR […]