Table of Contents

ToggleTop 10 Chexsystems-Free Banks for CPN Holders: Your Path to Banking Freedom

REF:

- https://www.forbes.com/advisor/banking/best-banks-no-chexsystems/

- https://www.creditinfocenter.com/banks-that-dont-use-chexsystems/

- https://www.gobankingrates.com/banking/banks/banks-dont-use-chexsystems/

When utilizing a Credit Privacy Number (CPN) with a bank, it’s advisable to begin with non-interest bearing checking accounts that do not report to ChexSystems.

If you attempt to upload an ID linked to your Social Security Number (SSN) while using your CPN, and that ID is already recorded in ChexSystems due to previous account issues, the bank will likely deny your account application. This is because ChexSystems tracks negative banking history.

It’s also important to differentiate between interest-bearing and non-interest bearing accounts when opening a new account. Many banks are required to report interest earnings annually. As part of this process, they verify the nine-digit numbers associated with these accounts—often presumed to be SSNs—against the Social Security Administration (SSA) records.

If the nine-digit number tied to your account is not registered with the SSA, the bank may contact you, requesting verification of your information. This is commonly a precursor to account closure, as they will instruct you to withdraw your funds.

Therefore, when establishing a new credit profile, it is crucial to understand the institutions you engage with and the implications of your banking choices. This knowledge will help you navigate potential challenges down the line.

That is why we’re presenting you this list of the top 10 banks offering non-interest bearing accounts that are not associated with ChexSystems.

These days, traditional banking practices are evolving in a swift manner. Various banks offer non-interest checking accounts that sidestep the conventional reliance on ChexSystems.

ChexSystems tracks the banking histories of an individual that include account closures and negative balances that impact an individual’s ability to open new accounts.

Finding the best banks not on Chexsystems is relatively easy now. Let’s dive into comprehensive insights on which banks don’t rely on Chexsystems and you can decide on which one is ideally suited to meet your needs.

People with imperfect banking histories come across various obstacles when they try to secure a new checking account.

However, numerous banks and credit unions are breaking away from this model and offering several options to their customers. The non-interest checking accounts bring the ultimate solution for people who have been marginalized in the past by the traditional banking system.

ChexSystems: An Overview

ChexSystems gives every individual a consumer score depending on how risky it can be if he opens a bank account. Between 100 to 899, the individual who has a lower score indicates higher risk.

By requesting the personal ChexSystems consumer score through fax or sending an email, one can get complete information. In comparison to consumers, this score is more useful for banks.

For people who come across so many problems in managing their bank accounts in the past, it is significant to know about the Chexsystems score or report. ChexSystems creates a database of folks and their banking history that encompasses comprehensive details on unpaid fees, bounced checks, and overdrafts.

Based on screening applications, banks determine potential risks and combat losses related to those account holders who have a history of financial mishandling.

Importance of ChexSystems Report

Reviewing and getting the ChexSystems report becomes important when any individual experiences identity theft or bank fraud. The report covers a wide range of things such as unpaid negative balances and doubtful fraudulent activities.

Be it a joint or solo account, the report includes every information that is easy to understand. If there is any negative account activity in the ChexSystems report and once it is confirmed that this activity is accurate, it will show in the report for five years.

Without the use of ChexSystems to access applications, these accounts are proving to be excellent for people who struggle with a wide range of financial setbacks and those who have limited banking histories. This approach is great towards financial inclusivity, making everyone realize that all people deserve access to basic banking services irrespective of their past.

Bypassing ChexSystems, the accounts come with a multitude of features that boost convenience and accessibility.

Lots of these accounts have minimal or no fees, easy online banking options, and effective account management tools. Every individual can get back on the right track with his finances, supporting an inclusive financial ecosystem that caters to an array of needs and situations.

The individuals with a blemished banking history look for banks to open second chance accounts. With these accounts, they get a limited number of services.

Contrary to this, the account holders also get the debit card access option. Slowly and gradually, the majority of people can build up a positive banking history with ChexSystems.

The overall concept of offering non-interest checking accounts without ChexSystems is an amazing way to make banking more accessible than ever before.

With these options, banks are increasing their client base and supporting an equitable approach to financial services, making sure that people can get chances to handle their money in an effective way.

More and more account holders of several banks are heading towards second chance banking options as they get opportunities to revamp their credit history and regain trust.

It is estimated that nearly 8,500 banks and credit unions across the US are using ChexSystems and the numbers are expected to grow in the prospective years.

Things to consider while checking whether you are in ChexSystems

Open the ChexSystems website and go to the request report section

Select a delivery method, by mail or online

Fill out the request form by providing comprehensive details

Agree to the terms and conditions

Submit the request

Advantages of choosing banks that don’t use ChexSystems:

A fresh start:

While applying for an account, your bank will not review the Chexsystem report, it gives you a fresh start and makes you worry-free.

Specific banking services:

Similar to a regular banking account, you can get some ultimate features such as debit card usage, bill payments, and online banking.

Rebuild a positive account history:

You can apply for credit-building features, regular banking accounts, and also, rebuild a positive account history with minimal effort.

Low Monthly Fees:

Most second chance checking accounts have no or lower monthly fees, proving to be affordable for you.

With banks that don’t use Chexsystems, one can enjoy modern banking features, restore their financial standing, and regain access to necessary banking services without any burden of past mistakes.

Top Reasons You Can Get Reported to ChexSystems:

Inadequate funds to cover transactions

Check bouncing

Overdraft fees not paid on time

Illegal or fraud activity in your account

Closing your account due to negative reasons

If you face a situation with any of the above-mentioned factors, you can raise a conflict with Chexsystems.

Gather every essential detail associated with your banking history, review the report attentively, gather evidence that supports your conflict, draft a conflict letter, keep copies of all the documents that you collect, and submit them to the website.

Within one month, you can get a response from them and if you aren’t satisfied with it, you can still explain to them what you have in your mind. Based on everything you share with them, they can cross check your details and give the right solution or suggestion accordingly.

Top Banks That Are Not On Chexsystems:

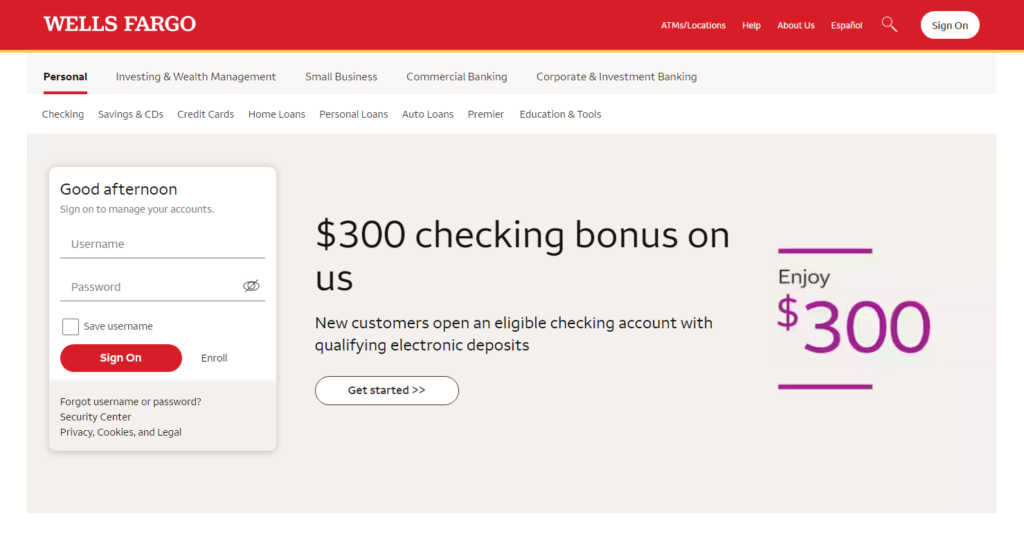

1. Wells Fargo

Many of us are unaware of some facts that the minimum opening deposit is $25, $5 is the fee for monthly maintenance, and the minimum balance is zero.

Wells Fargo’s Clear Access Banking account is perfect for those who look for an awesome banking experience, specifically for people who have a poor credit history and past banking issues.

With no connection with ChexSystems, Wells Fargo never hesitates in opening new accounts. They help their customers mitigate financial risks and gauge financial responsibility.

With no restricted features and higher fees, this one of the best banks not on Chexsystems gives an excellent option to its customers to improve their financial management.

Established its 47th position among the largest corporations of America, Wells Fargo offers an assorted range of mortgage, investment, and banking services and products.

This bank is widely recognized for its distinct approach to building a sustainable and inclusive future for its customers.

If anyone is struggling to open other bank accounts, this account is simply exceptional. In addition to this, one can also get a wide range of features including contactless debit cards, digital payments, and the Wells Fargo mobile app.

As per the recent statement of the CEO of this bank, they will continue to have a strong capital position and take superlative measures to boost their customer services.

For overdrafts and non-sufficient funds, there is no fee. The teen and student banking options are also available.

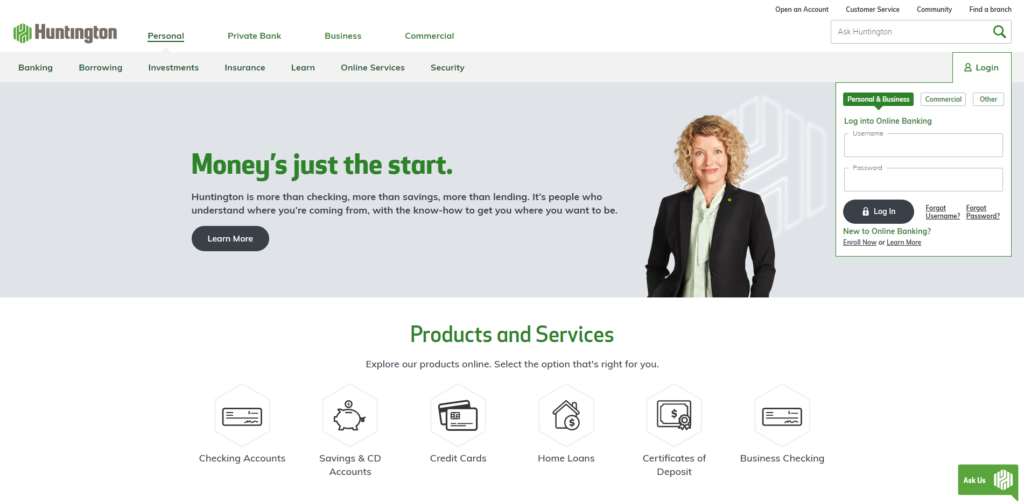

2. Huntington National Bank

Among the most popular banks not on chexsystems, Huntington National Bank offers an amazing banking option with an Asterisk-Free Checking account. Not requiring a ChexSystem report for approval, it is an outstanding choice for people who have been facing banking problems in the past. Featuring zero monthly maintenance fees, one can manage the finances in an efficient manner, and avoid unnecessary charges.

With Huntington’s Asterisk-Free Checking account, one can have financial peace of mind with some outstanding features such as a safety net when there are account balance discrepancies or unexpected expenses. Furthermore, everyone can handle risk management without any worry or stress.

With customer satisfaction, they offer top-quality services and products aligned with the preferences of account holders.

One can simplify the financial intricacies without any hard initiative through this bank.

This bank believes in maintaining transparency with its customers. They strip away unnecessary fees and give a straightforward and awesome banking experience.

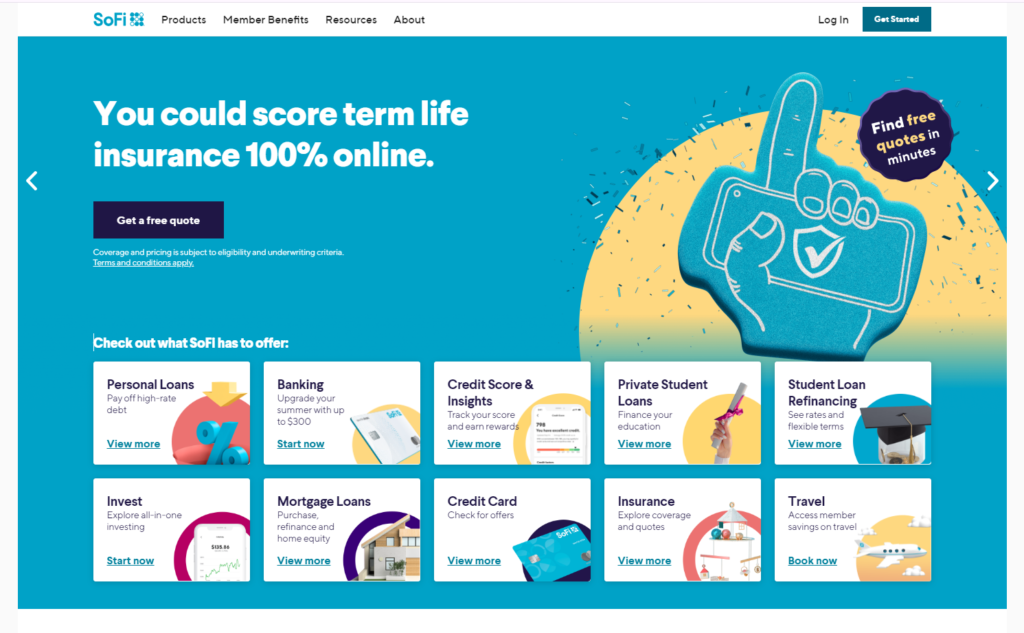

3. SoFi Bank

With an aim to provide a hassle-free banking experience, SoFi Bank serves the needs of those who want to avoid the financial barriers related to traditional banks.

Without any need to commit a significant amount of money upfront, new customers can start banking without any requirement for an initial deposit.

With no monthly maintenance fee, there is no chance of incurring regular charges for maintaining the account.

With no use of ChexSystems, SoFi Bank opens its doors for people who have trouble opening accounts with some financial institutions.

Without any stress of traditional banking pitfalls, everyone can build a positive banking history and manage the finances with ease. With an all-in-one app, this bank allows their customers to invest, earn, spend, and save their money.

From 4.50% APY on savings and 0.50% APY, Sofi bank brings a plethora of benefits for its users. After setting up direct deposits, one can experience the payday of two days earlier. No minimum balance fees, zero account fees, and no monthly fees are the benefits that their account holders can reap.

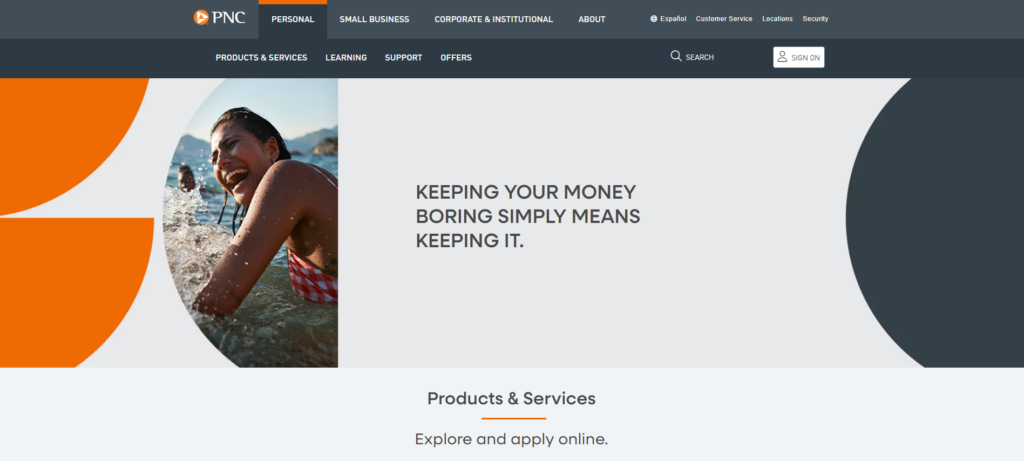

4. PNC Bank

Acknowledged for its client-centric approach, PNC Bank offers a range of banking services. Its policy has a feature of not using ChexSystems and this policy is extremely beneficial for people who have experienced hurdles with other financial institutions.

Under the category of banks that do not use ChexSystems, PNC Bank helps its customers minimize the traditional barriers that come from a negative banking history. This holistic approach shows PNC’s commitment to customer services and financial accessibility.

Without ChexSystems, PNC Bank provides the best opportunity to individuals to open accounts and access banking services with no possibility of risk.

This bank offers so many things such as personal loans, credit cards, checking and saving accounts. Its customers can reap advantages from features like mobile and online banking, through which they get complete access to financial and account management tools.

The branches and ATMs of this bank are several, making it easy to manage finances digitally or in person.

This approach makes this bank stand out as an institution with forward-thinking that values customer potential with over past drawbacks, supporting financial needs and fostering client relationships.

5. Varo Bank

As a modern digital bank, Varo Bank serves its customers through financial services primarily with the mobile app. For those who look for ways to manage their finances without the restrictions of traditional brick-and-mortar banks, this bank is simply exceptional.

Performing branchless banking can be made possible through this bank. For its second chance banking account, there are no hidden fees and monthly charges.

More than 40,000 ATMs, zero monthly fees, and zero minimum opening deposit, this bank has gained a reputation due to these factors.

The innovative features, zero minimum balance needs, competitive interests on saving accounts, and fee-free banking make it different from other financial institutions.

Established its position among the list of banks that don’t use chexsystems, this bank offers financial services and tools without relying on traditional credit checks that can be troublesome for various people.

A large number of customers can build financial health and access banking services.

Make gargantuan savings through Varo bank. Get 5.00% APY on up to $5k and earn 3.00% APY on everything. Through the Varo app, you can track your credit score. With the Varo Believe Card, build your credit and get benefits on your day-to-day purchases.

Their offerings include budgeting tools, direct deposits, and high-yield saving accounts that are useful for users in managing their finances incredibly well.

With a seamless digital experience and eliminating traditional banking fees, this bank empowers its clients to take comprehensive control over their financial lives, leading to financial inclusion and ease of access.

6. Navy Federal Credit Union

Referred as NFCU, Navy Federal Credit Union is a renowned financial institution that majorly serves military personnel and their families and helps them with the different aspects of banking services in comparison to traditional banks.

More than a non-chex chexsystems bank, it has emerged as a consumer reporting agency that tracks saving account activities while evaluating new account applicants.

This bank focuses on the right criteria to access applications that prove to be advantageous for people who have negative experiences with ChexSystems and face any intricacy while accessing traditional banking services.

Their mission is to offer inclusive financial services to its clients and support people with less-than-perfect banking histories.

The military families can get a welcoming environment and overcome their financial challenges with courage with the account management policies of this bank. To those who are serving the country, this bank provides the ultimate financial solutions.

7. GO2Bank

GO2Bank is a prominent financial institution that offers banking services and checking and saving accounts. Giving all the banking-related information is their core specialization. The customers can evaluate their past banking activities by applying for an account with this bank.

The monthly fee is $5 with zero minimum opening deposit, and this bank has above 42,000 ATMs. When a report shows a list of unresolved issues or account mismanagement problems, it can have a negative impact on the application.

However, this bank offers services to people who come across any problem while accessing traditional banking because of the past financial issues.

Not using a common tool like ChexSystem utilized by other banks, GO2Bank plays a vital role in rebuilding the financial stability of its customers.

The account holders find the right pathway to build better financial habits without any limitations often found in traditional banking environments.

The utmost benefit of using this bank’s services is that on savings up to $5,000, one can earn up to 4.50% APY. In addition to this, one can build credit with zero annual fees, making it perfect for those who seek ways to enhance their credit score.

While buying eGift cards from famous merchants in the app, one can earn up to 7% instant cashback.

8. Chime

With a prime focus on digital-first and user-friendly experience, this popular financial technology company offers banking services.

With no physical branch, it operates a network of partners. Its customers can reap benefits such as easy accessibility to different financial tools, zero transfer fees, zero minimum balance, no foreign transaction fees, zero overdraft fees, and no monthly fees.

Rather than relying on ChexSystems, Chime believes in fostering financial wellness for a wider audience. With an aim to make banking affordable and simpler, it helps its customers manage their money in a smart way.

Democratizing financial services and supporting financial growth for customers are some of the paramount goals of Chime. 24/7 live support, getting paid before 2 days with direct deposit, and no overdraft fee up to $200 are their prime features.

Chime second chance banking includes no monthly fee, zero minimum opening deposit, and nearly 60,000 ATMs.

From the past years, Chime has been counted as a fantastic platform for people with complicated banking histories. It gives plentiful solutions to people who fail to overcome the challenges of banking in the past.

With no barrier to traditional banking scrutiny, Chime helps people in restoring their financial health in the easiest way possible.

9. Mph.bank

For those who are baffled about what banks don’t use chexsystems, knowing about Mph.bank is a great decision. It accesses the risk profile of potential clients in a comprehensive manner.

Its goal is to guide people in managing their accounts responsibly and reducing the risk of potential financial problems.

To people with a clean banking history, it offers the simplest application process and access to various banking facilities.

This bank designs special programs and second-chance banking products to assist people in maintaining an optimal banking reputation.

They make sure that their account holders don’t miss out on the right opportunities to manage their finances. Without depending on ChexSystems, this bank opens doors for those who want to secure their financial future.

While setting up direct deposits, one can earn 5.00% APY and with add-on goals saving accounts, one can get the benefit of earning 3.00% APY.

This bank gives so many options to grow the money faster. Many people have accounts in various banks and charge hefty fees that drain their accounts. Mph.bank is best for them as they can save money with no overdraft fees, zero minimum balance, and no monthly fees.

One can maintain a secure and stable banking environment with minimal effort through this bank that makes a myriad of banking services accessible to its customers.

They provide the ultimate guidance on what exactly is impacting the banking eligibility of an individual.

10. United Bank

UnitedBank, a reputable financial institution, doesn’t utilize ChexSystems as part of the account approval process.

For reducing the likelihood of future financial issues, this bank gives valuable suggestions. One can get comprehensive details on negative balances, overdrafts, and account closures through this bank.

When an individual applies for an account with this bank, they always access his banking history. To people who have negative entries and frequent overdrafts, they give superlative solutions.

Also, those who have a clean record can experience a smooth-going application process and make different banking services and products within their reach.

For individuals who are unsure about what banks don’t use chexsystems, getting acquainted with its services is important.

For those with a denial of account applications or limitations on the types of accounts and services available, the services offered by UnitedBank are simply matchless.

Numerous banks and other platforms that don’t make use of Chexsystems:

Conclusion:

The above-mentioned is the list of banks that don’t use chexsystems. You can get an idea about how these banks function and what services and benefits they offer. Just compare the key features of these banks and choose the one wisely.

All these banks aren’t associated with ChexSystems and offer non-interest bearing accounts. With minimal fees, excellent features, and a focus on financial inclusion, these banks are playing a crucial role in creating accessible and equitable banking solutions.

If you find anything on this list to be an accurate please let us know as soon as possible so we can update this page for other people’s benefit.

Looking to start a legal new credit file?

Scroll to the top of this page and click on the phone number on the top right and we are always happy to help.

Register for free right now and a representative will call you during business hours to get you started.

Legal New Credit File

The legal team at TMMinistry of Civil Affairs© PMA A/K/A LNCF Stands as a beacon of hope for the traditional consumer. Comprising a dynamic association of members who operate as Attorneys-in-Fact for our PMA registered members, each brings a unique blend of expertise, passion, and dedication to the table.

With backgrounds in corporate law, civil rights, and criminal defense, they offer comprehensive legal services that cater to everyday people. Their mission is to provide legal clarity about consumer privacy while upholding the values of integrity, transparency, and client-focused service.

Since its inception, LNCF has made significant strides in the legal community, earning trust for their innovative approach to complex contract challenges in the privacy space.

The team’s collaborative spirit is the cornerstone of their success, allowing them to leverage their individual strengths in a unified strategy. Whether navigating high-stakes client transitions or offering in-depth consulting services, they remain committed to making a positive impact in the lives of their clients and the broader American community.