Table of Contents

ToggleREVOCATION OF ELECTION & HOW TO STOP PAYING TAXES, LEGALLY!

This audio file is one of the last remnants of a man with a lifetime commitment to securing his and others freedoms. What an amazing patriot – God bless him!

Get all the legal docments you need right HERE 3GB worth of priceless editable legal documents!

You ARE the Tax Collector – by Free State Ambassador – Patrick; Devine – 15min : 12s

HOW TO STOP PAYING TAXES, LEGALLY!

The Tax Collector is You!

Cancel your contracts by correcting your status and never pay taxes again!

Among other benefits!

Did you receive a letter for Notice of Deficiency/Tax Lien/Intent to Levy? STOP PAYING TAXES!

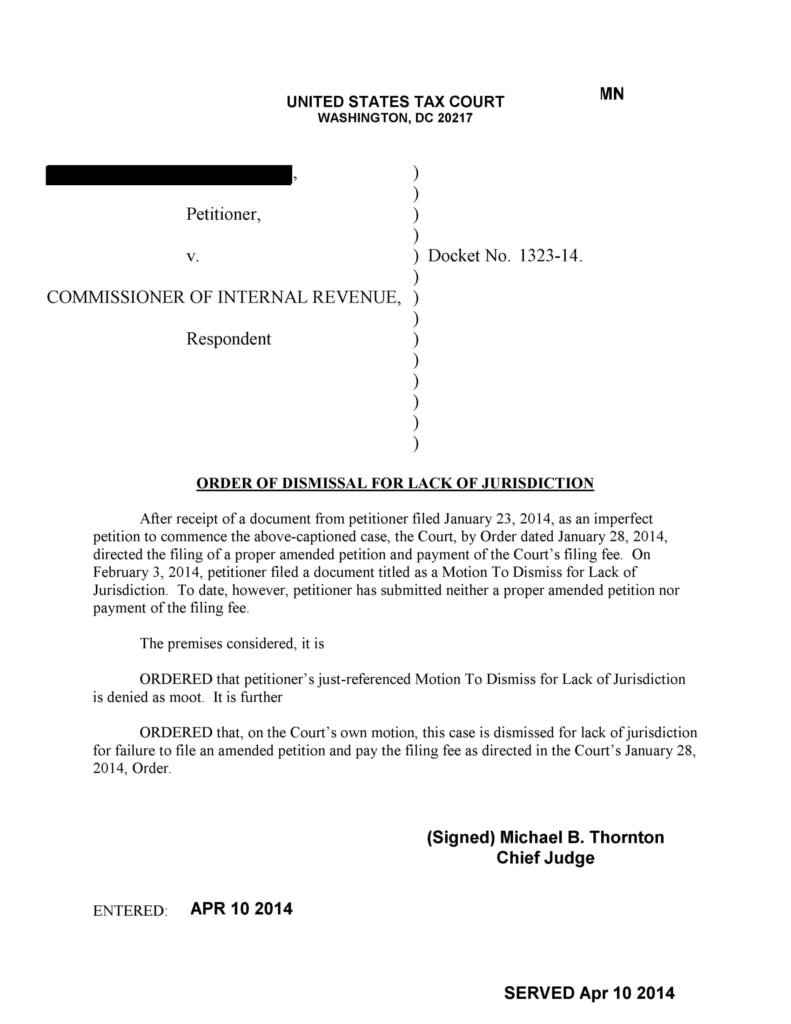

We may be able to obtain a Dismissal from the U.S. Tax Court. If you have received one or more of these letters, then we can help. For a Notice of Deficiency, you have likely received either a Letter 3219, Letter 3219N, Letter 950DO or Letter 1862.

U.S. Tax Court. If you have received one or more of these letters, then we can help. For a Notice of Deficiency, you have likely received either a Letter 3219, Letter 3219N, Letter 950DO or Letter 1862.

For a Notice of Federal Tax Lien, you have likely received a Form 668(Y). For a Notice of Intent to Levy, you have likely received a Letter 1058 or a Letter LT11.

If you qualify for our services, you can fight this enforcement action without having to hire an attorney or appear in court.

You simply use the mail to send correspondence to the Tax Court. And qualified candidates receive a 100% Money Back Guarantee that we will obtain a Dismissal for Lack of Jurisdiction from the USTC.

Time is critical on each of these actions to take this to Tax Court. So you need to act NOW!

The Statutory Notice of Deficiency, required by law, is issued to inform you that you owe additional tax, penalties and interest. You have the right to appeal this decision with the U.S. Tax Court. STOP PAYING TAXES!

Type of Notice: Return accuracy

Most common tax problem area: IRS tax audits

Other tax problem areas: IRS bill for unpaid taxes, IRS penalties, Unfiled tax returns

Why you received IRS Letter 3219

- The IRS proposed adjustments to your tax return, resulting in additional tax owed, or requested a tax return be filed.

- The IRS did not receive a response to the proposed adjustments. Or, if a return was requested, the IRS did not receive the return and prepared a return on your behalf, resulting in a balance due.

- The IRS is notifying you of your tax deficiency and explaining your right to file a petition with the Tax Court.

Your options to address IRS Letter 3219

- Dispute the taxes you owe

- Dispute the penalties

- Make arrangements to pay

Notice deadline: 90 days

If you miss the deadline: If you do not file a petition with the U.S. Tax Court, you lose your right to challenge the additional assessment of tax. The IRS will assess the tax, penalties and interest and send you a bill for the balance due.

Want more help?

STOP PAYING TAXES!

Example of U.S. IRS Tax Dismissal

How to get IRS Tax Dismissed as an action in Admiralty & STOP PAYING TAXES!

Action in Admiralty

Date: ______________________

From: Free State Ambassador – Patrick; Devine

c/o Godfather Devine – a US Private Enterprise Free State

18463 – 208th Avenue

Sigourney, Iowa, 52591-8236

Phone (641) 541-0035

To: CLERK OF COURT

U.S. Bankruptcy Court

for the Southern District of Iowa

300 U.S. Courthouse Annex

110 East Court Avenue, Suite 300

Des Moines, Iowa 50309-2035

SUBJECT: B-10 Form by a United States Private Enterprise Free State – Owner/Creditor.

Bankruptcy Clerk of Court,

I am submitting this Updated B-10, a Constitutional Free State’s Order, as a United States Constitutional Private Enterprise Free State Owner and Creditor in Admiralty per my Private Free State Rights and Powers, as addressed in the Constitution and the 10th Amendment.

Therefore, there is only one way for this United States Private Enterprise Free State to Recover its Inherit and Accrued Asset Value, that has been used by the UNITED STATES Federal Bankrupt Corporations per their Maritime Commercial Contracts and that is with a B-10 United States Private Enterprise Free State – State Creditor’s LIEU TAX Lien upon the Foreign Maritime Commercial Bankrupt Contracts to move them into a 24 hour State Ordered Involuntary Bankruptcy Settlement Liquidation process.

Therefore, as the U.S. Attorneys and U.S. Trustees are BAR Financial Agents working for the Chief Financial Officer of the BANKRUPT – UNITED STATES Federal Corporations, they are now required to process this United States Private Enterprise Free State – LIEU TAX, as my official State’s Constitutional Demand in Admiralty. As the Federal Corporations are operating under Maritime Commercial Contracts, this Foreign State Bankruptcy Lieu Tax Lien falls under the Constitutional Protected Rights of a Free State to have the Full Settlement within 24 hours.

Thank you for your time. You can call upon this Free State in peace at any time.

So Ordered by Private State Official: _______________________________

Free State Ambassador – Patrick; Devine

(Under Private Free State Official Seal)

ATTACHMENTS:

B-10 for STATE OF IOWA – Federal Maritime Commercial Contracted

Mother Vessel: PATRICK DEVINE; vessel # __________________.Copy of the STATE OF IOWA – Federal Maritime Commercial Contract

for the Mother Vessel: PATRICK DEVINE.Manifest of the Mother Vessel assigned Maritime support vessels.

STOP PAYING TAXES!

Many Americans believe that the federal income tax as it’s now imposed is likely unconstitutional. Among other factors, they base their reasoning on the wording of the 16th Amendment (which authorizes a federal income tax), interpreting it as never intended to tax wages and salaries earned in the private sector, as well as early court decisions involving that amendment.

The courts have regularly struck these arguments down. Occasionally, though, I read about a case in which prosecutors fail to convict a defendant who hasn’t filed federal returns or didn’t pay tax on their income, or was accused of tax evasion. One came to my attention a few weeks ago, when a jury was unable to reach a verdict in the federal prosecution of an Oregon man accused of willfully failing to file tax returns. The judge was thus forced to declare a mistrial.

The defendant, Michael E. Bowman, testified that based on his religious beliefs, he objected to paying tax to fund abortions and organizations such as Planned Parenthood that performed abortions. Based on his study of the US Constitution, the federal Religious Freedom Reformation Act, and the Oregon Constitution, he believed that the IRS was either required to accept or accommodate his religious objection. At least one member of the jury agreed with him.

Does this case demonstrate that if you have a good faith belief you don’t need to pay income tax, you don’t have to? Unfortunately, it’s not nearly that simple – or easy.

For starters, while Bowman has succeeded in staying out of prison for now, Uncle Sam can still go after his assets administratively and in civil litigation. Indeed, that’s what Oregon tax authorities have been doing. They’ve cleaned out his bank account and continue to collect taxes they believe Bowman owes. And since the jury didn’t acquit Bowman, he can be tried again for tax evasion.

In a federal criminal tax evasion trial, the prosecutor must convince a jury that you willfully failed to pay what you owe. Your attorney’s job is to convince the jury that your failure to pay tax wasn’t willful. And yes, you should always hire an attorney to represent you. After all, if you willfully attempt to evade or defeat a tax the IRS collects, you could be imprisoned up to five years, fined up to $100,000, or both, plus the costs of prosecuting the case. And if you’re convicted of willfully failing to collect or pay tax, you may be imprisoned up to five years, fined up to $250,000, or both, plus the costs of prosecution.

What’s now known as the “willfulness defense” is based on a 1991 Supreme Court case which overturned the conviction of a pilot named John Cheek for willfully failing to file tax returns and pay tax on his income. The Court held that:

“A good-faith misunderstanding of the law or a good-faith belief that one is not violating the law negates willfulness, whether or not the claimed belief or misunderstanding is objectively reasonable.”

STOP PAYING TAXES!

However,

“… a defendant’s views about the tax statutes’ validity are irrelevant to the issue of willfulness and should not be heard by a jury.”

We all know that “ignorance of the law is no excuse.” But with the Cheek case, the Supreme Court carved out a tiny exception to this rule. If you believe you aren’t required to pay federal income tax or file federal income tax returns, you can present evidence to support that belief to a jury to defend yourself in a criminal trial. But you can use the willfulness defense only in a federal criminal tax case. It won’t defeat a tax levy or other collection methods the IRS uses to collect tax. It won’t work against state tax collectors. And of course, there’s no guarantee a jury will believe that your failure to file tax returns or pay tax was non-willful.

In the 27 years since the Cheek case was decided, some criminal defendants have successfully used it to stay out of prison. But Cheek himself eventually spent a year in prison after being convicted of tax evasion in a second trial. He also paid the full amount the IRS claimed he owed, plus a penalty.

We regularly recommend to clients that they not take on the IRS and try to convince a jury they have a good-faith belief they don’t need to pay federal tax. The risks are simply too high, plus there are numerous legal ways to minimize or defer federal tax liabilities. Among them are contributions to Roth IRAs, solo 401(k) plans, defined benefit plans, and investments in qualified opportunity zones. We’ve written about all these opportunities for our registered members (If you’re not already a member, click here to register for free.)

What if you want to stop paying federal tax permanently, without risking seizure of your assets or imprisonment? In that case:

Many clients first get to know us by accessing some of our well-researched courses and reports on important topics that affect you.

You will be challenged to answer the questions of if you want to continue as a U.S. Citizen 14th amendment debt slave via the 1933 sham or if you want to change “tact” (lol, pun intended [nautical term]) and file jurisdictions’ in the air, land or sea for your particular situation.

Example of: “Notification of Revocation of Election and Request for Concurrence and Update the status of my Real Property”

STOP PAYING TAXES!

<<NAME>>

<<ADDRESS>>

<<CITY, STATE, ZIP>>

<<DATE>>

Director of International Operations

Internal Revenue Service

Washington, D.C. (20225)

Subject: Notification of Revocation of Election and Request for Concurrence and Update To My Taxpayer Status

Ref: 26 CFR 1.871-10

Dear Sir(s),

In accordance with 26 CFR § 1.871-10 (d)(2)(iii), this letter is being submitted in pursuit of a Revocation of Election to treat any or all of my income and assets as a nonresident alien from being considered by the IRS as “effectively connected with a trade or business in the ‘United States’”, as defined in 26 U.S.C. §864(b). Information about myself in fulfillment with the above CFR is as follows:

Name: ___________________________________________(full name, including middle name)

Address: __________________________________________________(full address)

Former SSN (no longer active): _________________

Applicable taxable year(s):__Current taxable year and beyond__ (must be submitted not later than 75 days after the close of the first taxable year for which it is desired to make the change)

Grounds for the request: My constitutional right to life, liberty, pursuit of happiness, privacy, respect, the fruits of my common right labors under common law, and the right to own and control property (including labor and the fruits of my labor) without any interference from government, or requirement to report, account for, such income or assets on such property.

This letter is by no means an admission in any way that I ever made a Election to treat any of my income or assets as effectively connected with a trade or business in the United States, but instead is submitted to ensure that my status is properly reflected in your records and that you do indeed concur with and respect this notification of request for your concurrence. I do not now nor have I ever lived in the ‘United States’ as defined in 26 U.S.C. Sec. 7701, nor do I have any intentions of doing so in the future. I am sorry if I ever gave you the idea that I did by, for instance, mistakenly filing an IRS form 1040 in the past, which was the incorrect form. The correct form is and always has been the 1040NR form.

Please note that I already have an IRS form W-8 on file with my employer and have accurately declared myself to be a Nonresident Alien. I reside outside the foreign jurisdiction to which the Internal Revenue Code (IRC) operates, which is the District of Columbia and federal territories:

“The United States government is a foreign corporation with respect to a state.”

N.Y. re: Merriam, 36 N.E. 505, 141 N.Y. 479, Affirmed 16 S.Ct. 1973, 41 L.Ed. 287

“In the United States of America, there are two (2) separated and distinct jurisdictions, such being the jurisdiction of the states within their own state boundaries, and the other being federal jurisdiction (United States), which is limited to the District of Columbia, the U.S. Territories, and federal enclaves within the states, under Article I, Section 8, Clause 17.” Bevans v. United States, 16 U.S. 336 (1818).

“State: The term ”State” shall be construed to include the District of Columbia, where such construction is necessary to carry out provisions of this title.” 26 U.S.C. Sec. 7701

United States:The term ”United States” when used in a geographical sense includes [is limited to] only the States [the District of Columbia and other federal territories within the borders of the states] and the District of Columbia. 26 U.S.C. Sec. 7701

“A canon of construction which teaches that of Congress, unless a contrary intent appears, is meant to apply only within the territorial jurisdiction of the United States.” U.S. v. Spelar, 338 U.S. 217 at 222 (1949)

“The term ‘United States’ may be used in any one of several senses. It may be merely the name of a sovereign occupying the position analogous to that of other sovereigns in the family of nations. It may designate the territory over which the sovereignty of the United States ex- [324 U.S. 652, 672] tends, or it may be the collective name of the states which are united by and under the Constitution.” Hooven & Allison Co. v. Evatt, 324 U.S. 652, 1945.

Foreign government: “The government of the United States of America, as distinguished from the government of the several states.” (Black’s Law Dictionary, 5th Edition)

Foreign Laws: “The laws of a foreign country or sister state.” (Black’s Law Dictionary, 6th Edition)

Foreign States: “Nations outside of the United States…Term may also refer to another state; i.e. a sister state. The term ‘foreign nations’, …should be construed to mean all nations and states other than that in which the action is brought; and hence, one state of the Union is foreign to another, in that sense.” (Black’s Law Dictionary, 6th Edition)

Treasury Decision 3980, Vol. 29, January-December, 1927, pgs. 64 and 65 defines the words includes and including as: “(1) To comprise, comprehend, or embrace…(2) To enclose within; contain; confine…But granting that the word ‘including’ is a term of enlargement, it is clear that it only performs that office by introducing the specific elements constituting the enlargement. It thus, and thus only, enlarges the otherwise more limited, preceding general language…The word ‘including’ is obviously used in the sense of its synonyms, comprising; comprehending; embracing.”

“Includes is a word of limitation. Where a general term in Statute is followed by the word, ‘including’ the primary import of the specific words following the quoted words is to indicate restriction rather than enlargement. Powers ex re. Covon v. Charron R.I., 135 A. 2nd 829, 832 Definitions-Words and Phrases pages 156-156, Words and Phrases under ‘limitations’.”

“In the interpretation of statutes levying taxes, it is the established rule not to extend their provisions by implication beyond the clear import of the language used, or to enlarge their operations so as to embrace matters not specifically pointed out. In case of doubt they are construed most strongly against the government and in favor of the citizen.” Gould v. Gould, 245 U.S. 151, at 153.

“Almost a century ago, Congress declared that “the right of expatriation [including expatriation from the District of Columbia or “U.S. Inc”, the corporation] is a natural and inherent right of all people, indispensable to the enjoyment of the rights of life, liberty, and the pursuit of happiness,” and decreed that “any declaration, instruction, opinion, order, or decision of any officers of this government which denies, restricts, impairs, or questions the right of expatriation, is hereby declared inconsistent with the fundamental principles of this government.” 15 Stat. 223-224 (1868), R.S. § 1999, 8 U.S.C. § 800 (1940).1 Although designed to apply especially to the rights of immigrants to shed their foreign nationalities, that Act of Congress “is also broad enough to cover, and does cover, the corresponding natural and inherent right of American citizens to expatriate themselves.” Savorgnan v. United States, 1950, 338 U.S. 491, 498 note 11, 70 S. Ct. 292, 296, 94 L. Ed. 287.2 The Supreme Court has held that the Citizenship Act of 1907 and the Nationality Act of 1940 “are to be read in the light of the declaration of policy favoring freedom of expatriation which stands unrepealed.” Id., 338 U.S. at pages 498-499, 70 S. Ct. at page 296.That same light, I think, illuminates 22 U.S.C.A. § 211a and 8 U.S.C.A.§ 1185.” Walter Briehl v. John Foster Dulles, 284 F2d 561, 583 (1957).

Thank you for your prompt and expeditious processing of this Revocation of Election. Please forward your certification and response to my address above. I respectfully request that you give a detailed explanation and legal justification of any determination or basis you might make regarding the disposition of this notification. This includes citing any authority you are exercising and the regulation or statute from which it derives, as well as any court cites, Treasury Decisions, etc that may be relevant to the foundation of your delegated authority for making a determination of disposition. This letter shall serve as formal legal notice that if you DO NOT respond within 45 days, then by your default and silence, the Revocation of Election is granted and there is no need to further contact us.

I affirm, under penalty of perjury, under the Common Law of America, without the “United States”, that the foregoing is true and correct, to the best of my current information, knowledge, and belief, per 28 U.S.C. 1746(1); and

I now affix my own signature to all of the above affirmations WITH EXPLICIT RESERVATION OF ALL MY RIGHTS AND WITHOUT PREJUDICE UCC 1-207 (UCCA 1207)

Very Respectfully,

<<NAME>>

All Rights Reserved, UCC 1-207

STATE OF _______________ )

COUNTY OF ______________ )

I do hereby certify that I am an adult over 18 years of age and have served _______________________________________________(name of agency or person served) with a true copy of the within document (circle one) (personally)/(by Certified Mail with Return Receipt Requested)/(by dropping in the U.S. Mail in a sealed envelope) to the address above, from _______________________________________________________________ (location, city and state mail was sent from).

Witness my hand and official seal.

Signature of Notary:_______________________________________

PROOF OF SERVICE

I do hereby certify that I am an adult over 18 years of age and have served _______________________________________________(name of agency or person served) with a true copy of the within document (circle one) (personally)/(by Certified Mail with Return Receipt Requested)/by dropping in the U.S. Mail to the address above, from _______________________________________________________________ (city and state mail was sent from).

Date:_______________________

1 See Carrington, Political Questions: The Judicial Check on the Executive, 42 Va.L.Rev. 175 (1956).

2 9 Pet. 692, 34 U.S. 692, 699, 9 L. Ed. 276.

As a Free State Ambassador:

Additional Relevant Data:

…”does hereby expressly state his desire to Terminate the Election made years ago via the congressionally created statute(s) in 26 USC §6013(g). Even though the statutory election was never stated openly prior to that election, his desire to ‘Terminate the Election’ is now clearly stated to those appropriate IRS operational personnel, IRS management, IRS Chief Legal Counsel, and the IRS Commissioner. As stipulated at 26 USC §6013(g)(4)(A), he now declares forevermore that he has exercised the option to Terminate the Election and upon receipt is no longer identified as one taxable like a Resident Alien. According to the Internal Revenue Code of 1954 statutes promulgated at 26 USC §6013(g)(6) Only one election, one finds expressed in this particular statute that if any election under this subsection is terminated under paragraph (4) Termination of Election (A) Revocation by taxpayers, that such individual(s) shall be ineligible to make an election under this subsection for any subsequent taxable year. Thus, once a Termination of Election occurs, which is the purpose of this Testimony properly submitted to the IRS Commissioner, et al; that can never again make an ‘election’ to become a taxpayer in the future. Federal Appeals Court 2nd Circuit The federal court decision in Economy Plumbing & Heating v. U.S., 470 F2d. (1972) stated the existence of both Lawful Taxpayers and Lawful Non-Taxpayers. “Revenue Laws relate to taxpayers and not to non-taxpayers. The latter are without their scope. No procedures are prescribed for non-taxpayers and no attempt is made to annul any of their Rights or Remedies in due course of law. With them [Non-taxpayers] Congress does not assume to deal and they are neither of the subject nor of the object of federal revenue laws.” [Emphasis & Clarification added] now reaffirms the desire and expressed intent to revert back to his rightful status of an American National who is “neither of the subject nor of the object of federal revenue laws.”

STOP PAYING TAXES!

TAX: A forced burden, charge, exaction, imposition, or contribution assessed in accordance with some reasonable rule of apportionment by authority of a sovereign state upon the persons or property within its jurisdiction to provide public revenue for the support of the government, the administration of the law, or the payment of public expenses. 51 Am J1st Tax § 3. Any payment exacted by the state or its municipal subdivisions as a contribution toward the cost of maintaining governmental functions, where the special benefit derived from their performance is merged in the general benefit. State ex rel. Fargo v Wetz, 40 ND 299, 168 NW 835, 5 ALR 731. A charge upon persons or property imposed by or under authority of the legislature for public purposes. Yosemite Lumber Co. v Industrial Acci. Com. 187 Cal 774, 204 P 226, 20 ALR 994.

Taxes are the enforced proportional contribution of persons and property, levied by the authority of the state for the support of the government and for all public needs, and so long as there exist public needs just so long exists the liability of the individual to contribute thereto. The obligation of the individual to the state is continuous and proportioned to the extent of the public wants. Patton v Brady, 184 US 608, 619, 46 L Ed 713, 719, 22 S Ct 493.

A tax is not regarded as a debt in the ordinary sense of the term, for the reason that a tax does not depend upon the consent of the taxpayer, and there is no express or implied contract to pay taxes. Taxes are not contracts between party and party, either express or implied; they are the positive acts of the government, through its various agents, binding upon the inhabitants and enforceable against them without reference to their personal or individual consent to be bound. Tax Com. v National Malleable Casting Co. 1 I 1 Ohio St 117, 144 NE 604, 35 ALR 1448.

The word “taxes,” as used in the priority provision of the Bankruptcy Act, is not to be construed in a limited sense, but as including all obligations imposed by the State or Political Subdivisions under their respective powers for governmental or public purposes. It includes any pecuniary burden laid upon individuals or property for the purpose of supporting the government or undertakings authorized by it, irrespective of the name given the imposition, or the method of collection. No distinction is observed between impositions under the police power and impositions under the taxing power. 9 Am J2d Bankr § 543.

The difference between a tax and a penalty is sometimes difficult to define, and yet the consequences of the distinction in the required method of their collection often are important. Where the sovereign enacting the law has power to impose both tax and penalty, the difference between revenue production and mere regulation maybe immaterial, but not so when one sovereign can impose a tax only, and the power of regulation rests in another. They do not lose their character as taxes because of the incidental motive. But there comes a time in the extension of the penalizing features of the so-called tax when it loses its character as such and becomes a mere penalty, with the characteristics of regulation and punishment. Bailey v Drexel Furniture Co. 259 US 20, 66 L Ed 817, 42 S Ct 449. See Special Assessment.

LIEU TAXES: Taxes on transportation or communication companies measured by the amount of their gross receipts, imposed in lieu of all other taxes upon the property of such concern or in lieu of taxes on certain classes of their property, such as that necessary to the carrying on of the business for which they were organized. Anno: 80 ALR 261, 277-279.

SPECIAL BASTARD: A bastard who was born before the marriage of his parents who intermarry thereafter. This was not bastardy by the ecclesiastical law, but by the common law, it is. See 3 Bl Comm 335.

SPECIAL ASSESSMENT: A local assessment; the levy of a burden upon property within a limited area for the payment for a local improvement supposed to be for the benefit of all property within the area. 48 Am J1st Spec A § 3.

The word “tax” as it is used in a statute is usually construed to have reference to taxation for general purposes, and not to local assessments. McIlroy v Ugitt, 182 Ark 1017, 33 SW2d 719, 73 ALR 1223. Local assessments do not come within the meaning of the word “tax” as used in the constitutional provision exempting lands of the state from taxation. Re Simpson, 43 Cal 2d 594, 275 P2d 467, 47 ALR2d 991.

In their ordinary sense, local assessments are not taxes, but they are taxes in the more general signification that they are a charge put upon property by authority of the lawmaking power. The general distinction is taken between taxes and local assessments that the former are forced contributions levied by the government alike upon all property, for the purpose of raising revenue for the support of the government without reference to the special benefits that will inure to the property thus taxed, while the latter are also forced contributions which are levied by the government, but upon certain particular property, with a view of raising revenue for certain designated purposes, having direct reference to the special benefits that will inure to the property thus taxed. Shreveport v Prescott, 51 La Ann 1895, 26 So 664; Altman v Kilburn, 45 NM 453, 116 P2d 812, 136 ALR 554.

SPECIAL ASSUMPSIT: Assumpsit upon an express contract or promise. 1 Am J2d Actions § 15.

ASSUMPSIT: A common law action by which compensation in damages may be recovered for the nonperformance of a contract express or implied, written or verbal, but not under seal and not of record. Board of Highway Comrs. v Bloomington, 253 Ill 164, 97 NE 280; 1 Am J2d Actions § 11.

TAXABLE PROPERTY: Property which is liable to taxation; property which is not exempt from taxation.

TAXATION: The assessment and collection of taxes, a power and process by which the sovereign raises revenue to defray the necessary expenses of government, apportioning the cost of government among those who in some measure are privileged to enjoy its benefits and must bear its burdens. Messer v Lang, 129 Fla 546, 176, 113 ALR 1073. An act of sovereignty to be performed, so far as it conveniently can be, with justice and equality to all. Union Pass. R. Co. v Philadelphia, 101 US 528, 25 L Ed 912. Graphically, but realistically stated, obtaining the greatest amount of feathers with the least squawking.

TAXATION AND REPRESENTATION: Concomitants under the American system of government. The rallying cry of the framers of the Federal Constitution. The principle was that the consent of those who were expected to pay the tax was essential to its validity. Hence, the Constitution provided that representatives and direct taxes should be apportioned among the states according to numbers, Article 1, Section 2, and that all duties, imports, and excises should be uniform throughout the United States, Article I, Section 8. Pollock v Farmers’ Loan & Trust Co. 157 US 429, 158 US 601, 39 L Ed 759, 1108, 15 S Ct 673, 912.

THE POWER TO TAX IS THE POWER TO DESTROY: A famous declaration of Chief Justice Marshall in McCulloch v State of Maryland, 4 Wheat (US) 431, 4 L Ed 579.

A striking instance of the truth of this proposition is seen in the fact that the existing tax of ten per cent, imposed by the United States on the circulation of all other banks than national banks, drove out of existence every state bank of circulation within a year or two after its passage. Loan Asso. v Topeka (US) 20 Wall 655, 22 L Ed 455.

13th Amendment:

Section 1. Neither Slavery nor Involuntary Servitude, except as a punishment for crime whereof the party shall have been duly convicted, SHALL EXIST within the United States, or any place subject to enforce jurisdiction.

Section 2. Congress shall have power to enforce this article by appropriate legislation.

PRIVATE RESIDENCE: A residence for one family ONLY. Anno: 18 ALR 460. See private dwelling house.

No person shall be a Representative who shall not have attained to the age of twenty-five years, and been seven years a citizen of the United States, and who SHALL NOT, when elected, be an INHABITANT of that State in which he shall be chosen. (This means they could only be in office one term, and then they were to set out the next term and if lucky be elected to a new one term of office.)

No person shall be a Senator who shall not have attained to the age of thirty years, and been nine years a citizen of the United States, and who SHALL NOT, when elected, be an INHABITANT of that State for which he shall be chosen. (This means they could only be in office one term, and then they were to set out the next term and if lucky be elected to a new one term of office.)

BREACH OF COVENANT: The Violation of a Covenant by an act or omission, depending upon whether the duty prescribed by the covenant is one of action or refraining from an act.

FRAUDULENT CONCEALMENT: The suppression of, or silence concerning, a fact material to be known and which the party is under a duty to communicate because of a confidential relationship between the parties or the particular circumstances of the case. American Nat. Bank v Fidelity & Deposit Co. 131 Ga 854, 63 SE 622. As a bar to discharge in bankruptcy:–the failure of the bankrupt to disclose his property to his trustee in bankruptcy after having had reasonable opportunity so to do. 9 Am J2d Bankr § 695. As a criminal offense against the Bankruptcy Act:–knowingly to conceal from the receiver, custodian, trustee, marshal, or other officer of the court charged with the custody or control of property, or from creditors in any proceeding under the Bankruptcy Act, any property belonging to the estate of a bankrupt; to conceal property knowingly, in contemplation of a bankruptcy proceeding, with intent to defeat the bankruptcy law. 18 USC § 152, paragraphs (1), (6).

CRIMINAL ACTION. An action by the sovereign; that is the state or the United States, or instituted on behalf of the sovereign, against one charged with the commission of a criminal act, for the enforcement of the penalty or punishment prescribed by law. 1 Am J2d Actions § 43.

CRIMINAL CONVERSATION: The tortious invasion of the rights of husband and wife which occurs when a third person has adulterous intercourse with one of them and for which the innocent and offended spouse has a cause of action against the adulterer. At common law no action lay on behalf of a wife for the seduction of her husband, but statute has changed this rule in the great majority of American jurisdictions. 27 Am J1st H & W § 535.

INHABITANT: A word impossible of precise and inclusive definition, since the meaning varies according to the context in which it appears, particularly where the matter is one of determining the legislative intent in a statute. 25 Am J2d Dom § 10. Narrowly, a dweller or householder, whether he be a tenant in fee simple, a life tenant, a tenant for years, a tenant at will, or one who has no interest in the premises other than that it is his habitation and dwelling. One having a domicil in a particular place. 25 Am J2d Dom § 10.

NEED TO LOOK-UP: Principality and State/Estate in a Good Dictionary

STOP PAYING TAXES!

9. For people in States of the Union, the Internal Revenue Code does not have the force of law,

30

but instead is only “code” and a state sponsored franchise and religion

31

According to the legislative notes under 1 U.S.C. §204, the Internal Revenue Code, Title 26, is NOT enacted into “positive

32

law” and only constitutes “prima facie” or “presumed” law. The U.S. Supreme Court held in Vlandis v. Kline that all

33

presumption which prejudices constitutionally guaranteed rights is unconstitutional:

34

(1) [8:4993] Conclusive presumptions affecting protected interests: A conclusive presumption [that a “code”

35

is in fact a “law”, for instance] may be defeated where its application would impair a party’s constitutionally-

36

protected liberty or property interests. In such cases, conclusive presumptions have been held to violate a party’s

37

due process and equal protection rights. [Vlandis v. Kline (1973) 412 U.S. 441, 449, 93 S.Ct. 2230, 2235;

38

Cleveland Bed. of Ed. v. LaFleur (1974) 414 U.S. 632, 639-640, 94 S.Ct. 1208, 1215-presumption under Illinois

39

law that unmarried fathers are unfit violates process]40

[Federal Civil Trials and Evidence, Rutter Group, paragraph 8:4993, p. 8K-34]41

Therefore, those protected by the Bill of Rights may not lawfully have “prima facie law”, meaning “presumption”, cited

42

against them as evidence in any court and if a judge permits this, he is violating his oath to support and defend the Constitution.

43

In fact, the American Jurisprudence Legal Encyclopedia 2d definitively says that presumption may not be used as a

44

SUBSTITUTE for evidence:

45

American Jurisprudence 2d

46

Evidence, §181

47

A presumption is neither evidence nor a substitute for evidence. 61 Properly used, the term “presumption” is a

48

rule of law directing that if a party proves certain facts (the “basic facts”) at a trial or hearing, the factfinder

49

61 Levasseur v. Field (Me) 332 A.2d. 765; Hinds v. John Hancock Mut. Life Ins. Co., 155 Me 349, 155 A.2d. 721, 85 ALR2d 703 (superseded by statute

on other grounds as stated in Poitras v. R. E. Glidden Body Shop, Inc. (Me) 430 A.2d. 1113); Connizzo v. General American Life Ins. Co. (Mo App) 520

SW2d 661.

Federal and State Tax Withholding Options for Private Employers

267

Copyright Family Guardian Fellowship , http://famguardian.org/

Ver. 2.12

EXHIBIT:_____________

must also accept an additional fact (the “presumed fact”) as proven unless sufficient evidence is introduced

1

tending to rebut the presumed fact. 62 In a sense, therefore, a presumption is an inference which is mandatory

2

unless rebutted. 63

3

The underlying purpose and impact of a presumption is to affect the burden of going forward. 64 Depending

4

upon a variety of factors, a presumption may shift the burden of production as to the presumed fact, or may shift

5

both the burden of production and the burden of persuasion. 65

6

A few states have codified some of the more common presumptions in their evidence codes.663 Often a statute

7

will provide that a fact or group of facts is prima facie evidence of another fact. 67 Courts frequently recognize

8

this principle in the absence of an explicit legislative directive. 68

9

The above implies that at least for people domiciled in states of the Union and protected by the Bill of Rights:

10

1. The Internal Revenue Code cannot be described as “law” or cited against them in any court, but instead is instead simply

11

a “Code”, or a “Title”, but not “law”. It is as “foreign” to a person domiciled in a state of the Union as the laws of

12

communist China are, in fact.

13

2. Citing the I.R.C. does not relieve the moving party, which is usually the government, of the burden of proving that the

14

sections of the code they are citing were enacted into positive law, and if they can’t prove it, they have no standing to

15

proceed in the case and the case must be dismissed.

16

3. Those who have had the code cited against them and do not challenge such a false presumption indirectly are implying

17

that they consent individually to be subject to it and are therefore “taxpayers”.

18

4. Those persons domiciled in states of the Union who cite any provision of the I.R.C. as their basis to proceed are admitting

19

that they are “taxpayers” subject to it. Here is what the U.S. Supreme Court said on this subject:

20

“The Government urges that the Power Company is estopped to question the validity of the Act creating the

21

Tennessee Valley Authority, and hence that the stockholders, suing in the right of the corporation, cannot [297

22

U.S. 323] maintain this suit. ….. The principle is invoked that one who accepts the benefit of a statute cannot

23

be heard to question its constitutionality. Great Falls Manufacturing Co. v. Attorney General, 124 U.S. 581;

24

Wall v. Parrot Silver & Copper Co., 244 U.S. 407; St. Louis Casting Co. v. Prendergast Construction Co., 260

25

U.S. 469.“

26

[Ashwander v. Tennessee Valley Auth., 297 U.S. 288 (1936)]27

________________________________________________________________________________________

28

“…when a State willingly accepts a substantial benefit from the Federal Government [including a law of the

29

Federal Government], it waives its immunity under the Eleventh Amendment and consents to suit by the intended

30

beneficiaries of that federal assistance.”

31

[Papasan v. Allain, 478 U.S. 265 (1986)]32

Below is the definition of “positive law” from the law dictionary which helps underscore these very important point.

33

“Positive law. Law actually and specifically enacted or adopted [approved and consented to] by proper authority

34

for the government [We the People] of an organized jural society. See also Legislation.”

35

[Black’s Law Dictionary, Sixth Edition, p. 1162]36

62 Inferences and presumptions are a staple of our adversary system of factfinding, since it is often necessary for the trier of fact to determine the existence

of an element of a crime–that is an ultimate or elemental fact–from the existence of one or more evidentiary or basic facts. County Court of Ulster County

v. Allen, 442 U.S. 140, 60 L.Ed.2d. 777, 99 S.Ct. 2213.

63 Legille v. Dann, 178 U.S. App DC 78, 544 F.2d. 1, 191 USPQ 529; Murray v. Montgomery Ward Life Ins. Co., 196 Colo 225, 584 P.2d. 78; Re Estate

of Borom (Ind App) 562 N.E.2d. 772; Manchester v. Dugan (Me) 247 A.2d. 827; Ferdinand v. Agricultural Ins. Co., 22 N.J. 482, 126 A.2d. 323, 62

ALR2d 1179; Smith v. Bohlen, 95 NC App 347, 382 S.E.2d. 812, affd 328 NC 564, 402 S.E.2d. 380; Larmay v. Van Etten, 129 Vt 368, 278 A.2d. 736;

Martin v. Phillips, 235 Va 523, 369 S.E.2d. 397.

64 FRE Rule 301.

65 §198.

66 California Evidence Code §§ 621 et seq.; Hawaii Rules of Evidence, Rules 303, 304; Oregon Evidence Code, Rule 311.

67 California Evidence Code § 602; Alaska Rule of Evidence, Rule 301(b); Hawaii Rule of Evidence, Rule 305; Maine Rule of Evidence, Rule 301(b);

Oregon Rule of Evidence, Rule 311(2); Vermont Rule of Evidence, Rule 301(b); Wisconsin Rule of Evidence, Rule 301.

68 American Casualty Co. v. Costello, 174 Mich App 1, 435 NW2d 760; Glover v. Henry (Tex App Eastland) 749 SW2d 502.

Federal and State Tax Withholding Options for Private Employers

268

Copyright Family Guardian Fellowship , http://famguardian.org/

Ver. 2.12

EXHIBIT:_____________

“Proper authority” above is the people’s elected representatives, because all power in this country derives from We The

1

People.

2

“In the United States, sovereignty resides in the people…the Congress cannot invoke sovereign power of the

3

People to override their will as thus declared.”

4

[Perry v. U.S., 294 U.S. 330 (1935)]5

“Sovereignty itself is, of course, not subject to law, for it is the author and source of law…While sovereign

6

powers are delegated to…the government, sovereignty itself remains with the people.”

7

[Yick Wo v. Hopkins, 118 U.S. 356 (1886)]8

Since the people domiciled in the states of the Union never enacted the Internal Revenue Code into “positive law”, they as

9

the “sovereigns” in our system of government never consented to enforce it upon themselves collectively. “Positive law” is

10

the only legally admissible evidence that the people ever explicitly consented to enforcement actions by their government of

11

a law, because legislation can only become positive law by a majority of the representatives of the sovereign people voting

12

(consenting) to enact the law. Since the people never consented, then the “code” cannot be enforced against the general

13

public. The Declaration of Independence says that all just powers of government derive from the “consent” of the governed.

14

Anything not consensual is, ipso facto, unjust by implication. In fact, the sovereign People REPEALED, not ENACTED the

15

Internal Revenue Code. It has been nothing but a repealed law since 1939, in fact. An examination of the Statutes at Large,

16

53 Stat 1, Section 4, reveals that the Internal Revenue Code and all prior revenue laws were REPEALED. See:

17

18

Revenue Act of 1939, 53 Stat. 1, SEDM Exhibit #05.027

http://sedm.org/Exhibits/ExhibitIndex.htm

Notice that we aren’t trying to imply here any of the following very false conclusions:

19

1. That the Internal Revenue Code is not “law” for people domiciled in the District of Columbia or working for the U.S.

20

government. It absolutely is.

21

2. That there are no persons subject to the Internal Revenue Code.

22

3. That Subtitle A of the I.R.C. doesn’t apply to anyone. Rather, the group of persons who are subject to it is far more

23

limited than most people realize.

24

4. That “taxpayers” are not subject to the Internal Revenue Code.

25

5. That there are no “taxpayers”.

26

If the Internal Revenue Code is not “law” or “positive law” for people domiciled in states of the Union, then every regulation

27

that implements it does not have the force of “law” either. Consequently, the “code” and the regulations that implement it

28

are nothing but a state-sponsored official religion not unlike the early Anglican Church was. It is what we call a “political

29

religion” in violation of the First Amendment, where:

30

1. This false and evil religion meets all the criteria for being described as a “cult”, because:

31

1.1. The cult imposes strict rules of conduct that are thousands of pages long and which are far more restrictive than

32

any other religious cult.

33

1.2. Participating in it is harmful to our rights, liberty, and property.

34

1.3. The “cult” is perpetuated by keeping the truth secret from its members. Our Great IRS Hoax, Form #11.302

35

contains 2,000 pages of secrets that our public servants and the federal judiciary have done their best to keep

36

cleverly hidden and obscured from public view and discourse. When these secrets come out in federal courtrooms,

37

the judges make the case unpublished so the American people can’t learn the truth about the misdeeds of their

38

servants in government. Don’t believe us? Read the proof for yourself:

39

http://www.nonpublication.com/

40

1.4. Those who try to abandon this harmful cult are threatened and harassed illegally and unconstitutionally by covetous

41

public dis-servants.

42

2. The “bible” of this false religious “cult” is the “Infernal (Satanic) Revenue Code”

43

3. The U.S. Congress are the false “prophets”, who wrote their “bible” to serve their own private political agenda.

44

4. People join the cult mainly in order to minimize their liability for persecution from the enforcement unit for the cult,

45

which is the IRS.

46

5. The courtroom is where “worship services” are held. Even the seats are the same as church pews!

47

6. Tax preparation businesses all over the country like H.R. Block are where “confession” is held annually to “deacons” of

48

the cult.

49

Federal and State Tax Withholding Options for Private Employers

269

Copyright Family Guardian Fellowship , http://famguardian.org/

Ver. 2.12

EXHIBIT:_____________

7. The judges are the false “god” of this religion, who rule by their own might and ignore the limits of the Constitution, at

1

least in the context of taxation. Attorneys “worship” these false gods.

2

8. The judge, like the church pastor, wears a black robe and chants in Latin. Many legal maxims are Latin phrases that

3

have no meaning to the average citizen, which is the very same thing that happens in Catholic churches daily across the

4

country.

5

9. The jury are the twelve disciples of the judge, rather than of the Truth or the law or their conscience. Their original

6

purpose was as a check on government abuse and usurpation, but judges steer them away from ruling in such a manner

7

and being gullible sheep raised in the public “fool” system, they comply to their own injury.

8

9.1. Those who are not already members of the cult are not allowed to serve on juries. The judge or the judge’s

9

henchmen, his “licensed attorneys” who are “officers of the court”, dismiss prospective jurists who are not cult

10

members during the voir dire (jury selection) phase of the tax trial. The qualifications that prospective jurists must

11

meet in order to be part of the “cult” are at least one of the following:

12

9.1.1. They collect government benefits based on income taxes and don’t want to see those benefits reduced or

13

stopped. The only people who can collect federal benefits under enacted law and the Constitution are federal

14

employees. Therefore, they must be federal employees. Since jurists are acting as “voters”, then receipt of

15

any federal benefits makes them into a biased jury in the context of income taxes and violates 18 U.S.C. §597,

16

which makes it illegal to bribe a voter. The only way to eliminate this conflict of interest is to permanently

17

remove public assistance or to recuse/disqualify them as jurists.

18

9.1.2. They faithfully pay what they “think” are “income taxes”. They are blissfully unaware that in actuality, the

19

1040 return is a federal employment profit and loss statement.

20

9.1.3. They believe or have “faith” in the cult’s “bible”, which is the Infernal Revenue Code and falsely believe it is

21

“law”. Instead, 1 U.S.C. §204 legislative notes says it is NOT positive law, but simply “presumed” to be law.

22

Presumption is a violation of due process and therefore illegal under the Sixth Amendment.

23

9.1.4. They are ignorant of the law and were made so in a public school. They therefore must believe whatever any

24

judge or attorney tells them about “law”. This means they will make a good lemming to jump off the cliff

25

with the fellow citizen who is being tried.

26

9.2. Juries are FORBIDDEN in every federal courthouse in the country from entering the law library while serving on

27

a jury because judges don’t want jurists reading the law and finding out that judges are misrepresenting it in the

28

courtroom. Don’t believe us? Then call the law library in any federal court building and ask them if jurists are

29

allowed to go in there and read the law while they are serving. Below are the General Order 228C for the Federal

30

District Court in San Diego proving that jurors are not allowed to use the court law library while serving. Notice

31

jurors are not listed as authorized to use the library in this order:

32

http://famguardian.org/Disks/TaxDVD/Evidence/JudicialCorruption/GenOrder228C-Library.pdf

33

9.3. Unlike every other type of federal trial, judges forbid discussing the law in a tax trial. Could it be because we don’t

34

have any and he doesn’t want to admit it?

35

9.4. Public (government) schools deliberately don’t teach law or the Constitution either, so that the public become sheep

36

that the government can shear and rape and pillage.

37

9.5. Federal judges also warn juries these days NOT to vote on their conscience, as juries originally did and were

38

encouraged to do. He does this to steer or direct the jury to do his illegal and unconstitutional dirty work. He turns

39

the jury effectively into an angry lynch mob and thereby maliciously abuses legal process for his own personal

40

benefit in violation of 18 U.S.C. §208. He helps get the jury angry at the defendant by giving them the idea that

41

their “tax” bill will be bigger because the defendant refuses to “pay their fair share”.

42

10. Those who refuse to worship the false god and false religion (which the Bible describes in the Book of Revelations as

43

“the Beast”) are “exorcised” from society by being put into jail so that they don’t spread the truth about the total lack of

44

lawful authority to institute income taxation within states of the Union. They are jailed as political prisoners by

45

communist judges and socialist fellow citizens, just like in the Soviet Union. You can read more about this at:

46

http://famguardian.org/Publications/SocialSecurity/TOC.htm

47

11. The lawyers representing both sides are licensed by the priest/judge and therefore will pay homage to and cooperate with

48

him fully or risk losing their livelihood and becoming homeless. Every tax trial has THREE prosecutors who are there

49

to prosecute you: your defense attorney, the opposing U.S. attorney, and the judge, all of whom are on the take. Attorneys

50

have a conflict of interest and it is therefore impossible for them to objectively satisfy the fiduciary duty to their clients

51

which they have under the law. You can read more about this scam at:

52

http://famguardian.org/Subjects/LawAndGovt/LegalEthics/PetForAdmToPractice-USDC.pdf

53

12. The capitol, Washington D.C., is the “political temple” or headquarters of this false religious cult. Don’t believe us?

54

During the Congressional debates of the Sixteenth Amendment in 1909, one Congressman amazingly admitted as much.

55

The Sixteenth Amendment is the income tax amendment that was later fraudulently ratified in 1913. Notice the use of

56

the words “civic temple” and “faith” in his statement, which are no accident.

57

Federal and State Tax Withholding Options for Private Employers

270

Copyright Family Guardian Fellowship , http://famguardian.org/

Ver. 2.12

EXHIBIT:_____________

“Now, Mr. Speaker, this Capitol is the civic temple of the people, and we are here by direction of the people to

1

reduce the tariff tax and enact a law in the interest of all the people. This was the expressed will of the people at

2

the polls, and you promised to carry out that will, but you have not kept faith with the American people.”

3

[44 Cong.Rec. 4420, July 12, 1909; Congressman Heflin talking about the enactment of the Sixteenth

4

Amendment]5

If you want to read the above amazing admission for yourself, visit our website at:

6

http://famguardian.org/TaxFreedom/History/Congress/1909-16thAmendCongrRecord.pdf

7

13. Representatives of this church/cult, such as the Department of Justice and the IRS, dress the same as Mormon

8

missionaries.

9

14. Those who participate in this cult can write-off or deduct their contributions just like donations to any church. State

10

income taxes, for instances, are deductible from federal gross income.

11

15. The false god/idol called government gets the “first fruits” of our labor, before the Lord even gets one dime, using payroll

12

deductions. Some employers treat the payroll deduction program like it is a law to be followed religiously, even though

13

it is not. This is a violation of Prov. 3:9, which says:

14

“Honor the LORD with your possessions, And with the firstfruits of all your increase;”

15

[Prov. 3:9, Bible, NKJV]16

Yes, people, the government has made itself into a religion, at least in the realm of taxation. The problem with this corruption

17

of our government is that the U.S. Supreme Court said they cannot do it:

18

“The “establishment of religion” clause of the First Amendment means at least this: neither a state nor the

19

Federal Government can set up a church. Neither can pass laws which aid one [state-sponsored political]20

religion, aid all religions, or prefer one religion over another. Neither can force or influence a person to go to

21

or to remain away from church against his will, or force him to profess a belief or disbelief in any religion. No

22

person can be punished for entertaining or professing religious beliefs or disbeliefs, for church attendance or

23

non-attendance. No tax in any amount, large or small, can be levied to support any religious activities or

24

institutions, whatever they may be called, or whatever form they may adopt to teach or practice religion.

25

Neither a state nor the Federal Government can, openly or secretly, participate in the affairs of any religious

26

organizations or groups and vice versa.”

27

[Everson v. Bd. of Ed., 330 U.S. 1, 15 (1947)]28

__________________________________________________________________________________________

29

“[T]he Establishment Clause is infringed when the government makes adherence to religion relevant to a

30

person’s standing in the political community. Direct government action endorsing religion or a particular

31

religious practice is invalid under this approach, because it sends a message to nonadherents that they are

32

outsiders, not full members of the political community, and an accompanying message to adherents that they are

33

insiders, favored members of the political community”.

34

[Wallace v. Jaffree, 472 U.S. 69 (1985)]35

If you would like additional hard evidence supporting the above fascinating scientific conclusion, then please read the

36

following supporting evidence:

37

1. Socialism: The New American Civil Religion, Form #05.016:

38

http://sedm.org/Forms/FormIndex.htm

39

2. The Great IRS Hoax, Form #11.302 book available free at:

40

http://famguardian.org/Publications/GreatIRSHoax/GreatIRSHoax.htm

41

2.1. Section 4.3.2: Biblical view of taxation and government

42

2.2. Section 4.3.12: Our Government has become idolatry and a false religion

43

2.3. Sections 5.4 through 5.4.3.6: The I.R.C. is not law

44

3. Tax Deposition Questions, Section 5: First Amendment and Socialism

45

http://famguardian.org/TaxFreedom/Forms/Discovery/Deposition/Deposition.htm

46

4. The Unlimited Liability Universe, Family Guardian Fellowship:

47

http://famguardian.org/Subjects/Spirituality/Articles/UnlimitedLiabilityUniverse.htm

48

5. Government is a Pagan Cult and We’ve all Been drinking the Kool-Aid, Family Guardian Fellowship:

49

http://famguardian.org/Subjects/LawAndGovt/ChurchVState/GovtPaganCult.htm

50

6. How Scoundrels Corrupted Our Republican Form of Government, Family Guardian Fellowship:

51

http://famguardian.org/Subjects/Taxes/Evidence/HowScCorruptOurRepubGovt.htm

52

The only reasons anyone follows a repealed law as though it were a false religion is one of the following:

53

Federal and State Tax Withholding Options for Private Employers

271

Copyright Family Guardian Fellowship , http://famguardian.org/

Ver. 2.12

EXHIBIT:_____________

1. They are dangerously stupid

1

2. They want to be part of the official state sponsored religion and be “politically correct”.

2

3. They are more afraid of what a corrupted tyrant judge with a conflict of interest will do to them than what God will to

3

them for disobeying His laws. God’s laws say we cannot be slaves to any man and that we cannot worship false gods or

4

“priests” of false gods such as tyrant judges who are perpetuating the worship and obedience to socialism and humanism.

5

We call this religion the “Civil Religion of Socialism and Humanism”. One of the reasons why the I.R.C. does not have the

6

FORCE of law for the average American and can never be PUBLIC law that applies equally to ALL in a free country is that

7

the First Amendment prohibits establishing religion by law. Therefore, Congress wrote a “proposal” or contract called the

8

Internal Revenue Code and then duped everyone into accepting the contract by sending in the wrong tax forms to the IRS.

9

Compliance is then maintained by “judge made law”, because Congress put the federal judiciary under the control of the IRS

10

for the first time starting in 1932. The judges rebelled, but Congress was so sneaky how they did it that the Supreme Court

11

couldn’t stop them. From that point on, the judges would be destroyed by the IRS if they didn’t rule in the IRS’ favor69. The

12

First Amendment doesn’t prohibit the judiciary from establishing a religion, and that is exactly what these corrupted judges

13

have done under the influence of IRS extortion. Remember what the Declaration of Independence says on this subject and

14

the complaint we had about the British King that caused us to rebel? Well the very same problem is again back in our midst:

15

“He has made Judges dependent on his [the Executive Branch/President and the IRS he controls] Will alone,

16

for the tenure of their offices, and the amount and payment of their salaries.

17

”He has erected a multitude of New [IRS] Offices, and sent hither swarms of Officers to harass our people,

18

and eat out their substance.”

19

[SOURCE: http://www.archives.gov/national_archives_experience/charters/declaration_transcript.html]20

What are YOU going to do about this cancer on the body politic, folks? America will only be the land of the free as long as

21

it is the home of the brave. The Ten Commandments say “Thou shalt not steal.” They don’t say “Thou shalt not steal

22

UNLESS you are the government.” We realize that some of this section may sound strange and maybe even radical at first

23

glance, but we scientifically prove all assertions made here using the government’s own laws and court rulings in sections

24

5.4.3.2 and 5.4.3.6 of the Great IRS Hoax, Form #11.302 book available below. We encourage you to read the eye-popping

25

truth for yourself and rebut it if you can. Don’t believe a word we say, but read the law for yourself:

26

Great IRS Hoax, Form #11.302

http://famguardian.org/Publications/GreatIRSHoax/GreatIRSHoax.htm

Instead, the I.R.C. can only be enforced against groups of people whose consent is not required. The only group of people

27

that fits that description are federal “employees”, contractors, agencies, and benefit recipients. This is confirmed by

28

examining the Federal Register Act, 44 U.S.C. §1505(a)(1) and the Administrative Procedures Act, 5 U.S.C. §553(a), both

29

of which confirm that no enforcement implementing regulations are required in the case of the following persons, who in fact

30

are the only proper or lawful subject of the Internal Revenue Code Subtitle A:

31

1. 44 U.S.C. §1505(a)(1): Federal agencies or persons in their capacity as officers, agents, or employees

32

2. 5 U.S.C. §553(a)(1): Military or foreign affairs function of the United States

33

3. 5 U.S.C. §553(a)(2): Matters relating to agency management or personnel or to public property, loans, grants, benefits,

34

or contracts

35

The following document proves that there are no enforcement implementing regulations and that the only group the IRS can

36

enforce the I.R.C. against are federal instrumentalities, agencies, contractors, and benefit recipients:

37

IRS Due Process Meeting Handout, Form #03.008

http://sedm.org/Forms/FormIndex.htm

Therefore, the above groups are the only proper subject of I.R.C. Subtitle A, the personal and business income tax. Subtitle

38

A of the Internal Revenue Code therefore amounts to an implied employment agreement between the United States

39

government and the federal “employees” and contractors and agencies who work for it. Those who don’t want to consent to

40

the employment or contract simply will do so by not seeking federal employment or contracts. Those who work for the

41

69 See O’Malley v. Woodrough, 307 U.S. 277 (1938) and Great IRS Hoax, Section 6.9.9.

Federal and State Tax Withholding Options for Private Employers

272

Copyright Family Guardian Fellowship , http://famguardian.org/

Ver. 2.12

EXHIBIT:_____________

federal government, by virtue of being granted the privilege, must refund a portion of their paycheck back to the government.

1

The amount returned is the “tax” and the “gross income” upon which it is based is all the earnings from the public office,

2

which is called “income effectively connected with a trade or business in the United States” under the I.R.C. That is why

3

what you file at the end of every year is called a “return”. There is a very good reason it is called a “return”! Those who

4

receive this government “overpayment”, while it is temporarily in their possession, are treated as “transferees” and fiduciaries

5

of the federal government until the money is returned to its rightful owner. What this scheme amounts to essentially is a

6

“federal employee kickback program” disguised to look like a lawful income tax. The reason this type of deception was

7

necessary is because the Constitution forbids direct taxes in Article 1, Section 9, Clause 4 and Article 1, Section 2, Clause 3.

8

Therefore, the government took the back door to deceive the people so they could literally STEAL their money under the

9

pretext of lawful authority. The scam started in 1862 and was instituted as an “emergency measure” to pay for the civil war,

10

but it survives to this day to plague us. Since that time, the scoundrels have taken great pains to obfuscate IRS Forms,

11

publications, and the Internal Revenue Code to fool the average person into believing that they are what amounts to “public

12

employees” under the I.R.C and thereby expand the operation of the “scheme”. See the following for more complete details

13

on this monumental scam.

14

Great IRS Hoax, Form #11.302, Section 5.6.10

http://famguardian.org/Publications/GreatIRSHoax/GreatIRSHoax.htm

Don’t believe us? We’ve got a signed admission by the government’s own employees that this is the case. See:

15

16

Cynthia Mills Letter, SEDM Exhibit #09.023

http://sedm.org/Exhibits/ExhibitIndex.htm

If you would like to know more about the content of this section, please consult the following memorandum of law below:

17

Requirement for Consent, Form #05.003

http://sedm.org/Forms/FormIndex.htm

10. Federal Tax Scheme

STOP PAYING TAXES!

Legal New Credit File

The legal team at TMMinistry of Civil Affairs© PMA A/K/A LNCF Stands as a beacon of hope for the traditional consumer. Comprising a dynamic association of members who operate as Attorneys-in-Fact for our PMA registered members, each brings a unique blend of expertise, passion, and dedication to the table.

With backgrounds in corporate law, civil rights, and criminal defense, they offer comprehensive legal services that cater to everyday people. Their mission is to provide legal clarity about consumer privacy while upholding the values of integrity, transparency, and client-focused service.

Since its inception, LNCF has made significant strides in the legal community, earning trust for their innovative approach to complex contract challenges in the privacy space.

The team’s collaborative spirit is the cornerstone of their success, allowing them to leverage their individual strengths in a unified strategy. Whether navigating high-stakes client transitions or offering in-depth consulting services, they remain committed to making a positive impact in the lives of their clients and the broader American community.